Contractor Information for 1099 Forms

The logic Wingspan uses to determine what contractor information will appear on the Form 1099.

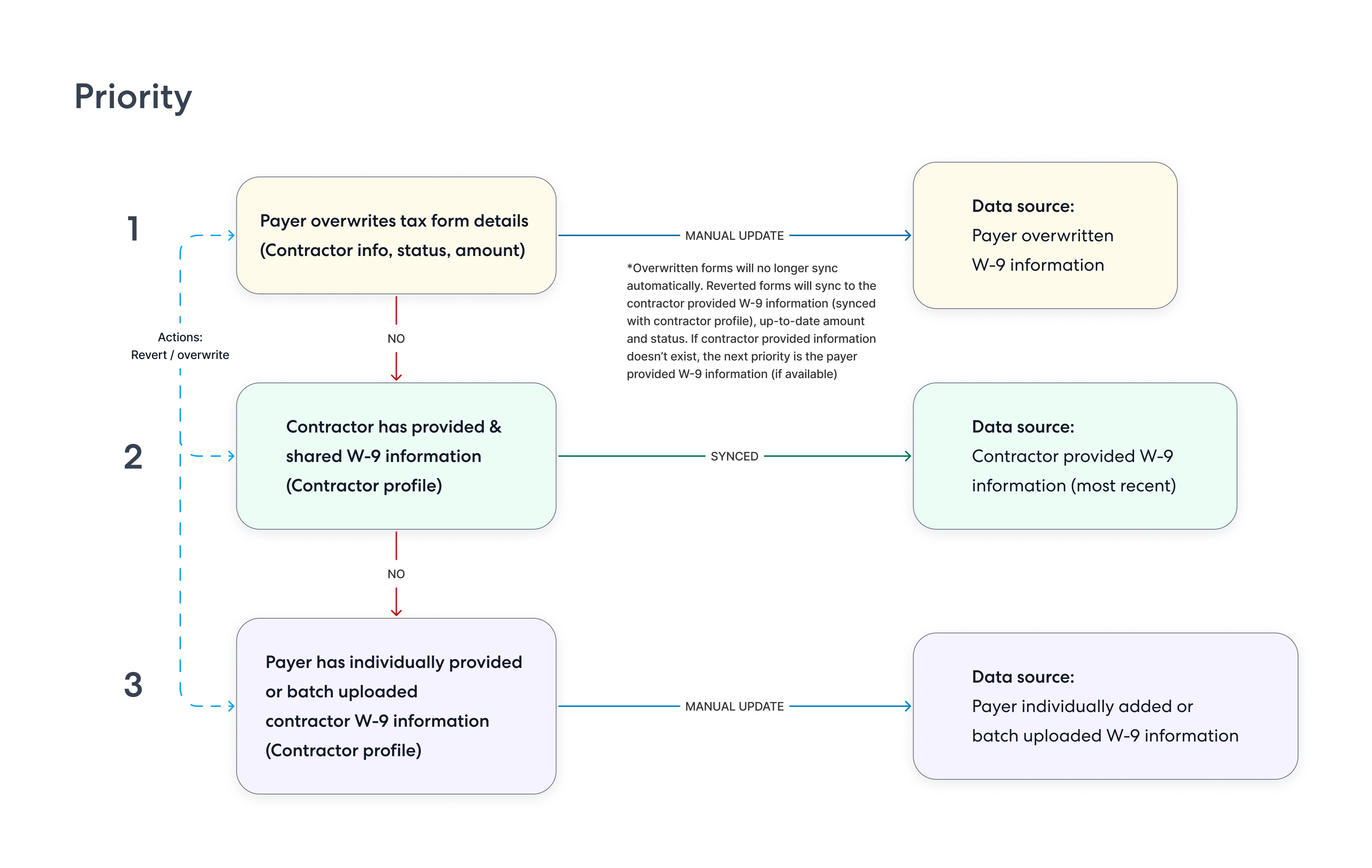

Before the 1099 forms are in the status of Submitted, Rejected, or Accepted, they are in the "pre-filing" stage. Think of this stage as the preparatory phase, where all necessary details are being gathered and cross-checked. During this stage, contractor information can be updated or modified in one of three primary ways (in order or priority):

Diagram showing determination logic for contractor information

- Payer Overwrites: The payer (you or a team member) manually overwrites the contractor's form details in Wingspan, such as their name, Tax Identification Number (TIN), address, status or amount. The overwritten information appears only on the tax form and is no longer synced with the contractor profile.

Example: If a company realizes they have the wrong address for a contractor in Wingspan, they can manually correct it while still in the pre-filing stage. - Contractor Provided W-9 info: The contractor themselves provides their W-9 information in Wingspan, which then gets updated in real-time. If this information exists on the contractor profile, it will be synced to the pre-submission tax forms automatically.

Example: A freelancer updates their address in Wingspan during the pre-filing stage. The changes will be reflected on the 1099 form provided the form has not been submitted. - Payer Provided W-9 info: The payer provides the contractor's W-9 information in Wingspan on their behalf, which then gets updated in real-time.

If this information exists on the contractor profile, it will be synced to the pre-submission tax forms automatically.

Example: A payer updates a freelancer's address in Wingspan during the pre-filing stage. The changes will be reflected on the 1099 form provided the form has not been submitted.

It's crucial to note that during this pre-filing stage, any changes or edits made by either the payer or contractor to the contractor profile in Wingspan will be reflected on the tax form based on the priority described above.

Wingspan’s Logic for Determining 1099 Contractor Information

-

TIN Determination (EIN vs. SSN)

-

If the contractor has an EIN available and prefers using it:

- Name: The contractor’s legal business name.

- TIN: EIN.

- Address: The registered business address; if none is available, the system uses the personal address.

-

Otherwise, if only an SSN is provided, the system checks the contractor’s business structure:

-

Sole Proprietor or Single-Member LLC

- Name: If there is a separate legal business name in addition to a first and last name, both appear together. Otherwise, the name is just “FirstName LastName.”

- TIN: SSN.

- Address: Personal address.

-

Other Eligible Structures

- Name: The individual’s first and last name.

- TIN: SSN.

- Address: Personal address.

-

-

Updated 7 days ago