Set Up 1099 Filing

Configure Wingspan to collect contractor details, choose 1099-NEC or 1099-MISC (Box 6), and prepare payment data ahead of the 2025 filing season.

Beginning December 16, 2025, administrators can review their tax profile, choose which form type to file (1099-NEC or 1099-MISC Box 6), and prepare payment data for the 2025 filing season.

Getting Started

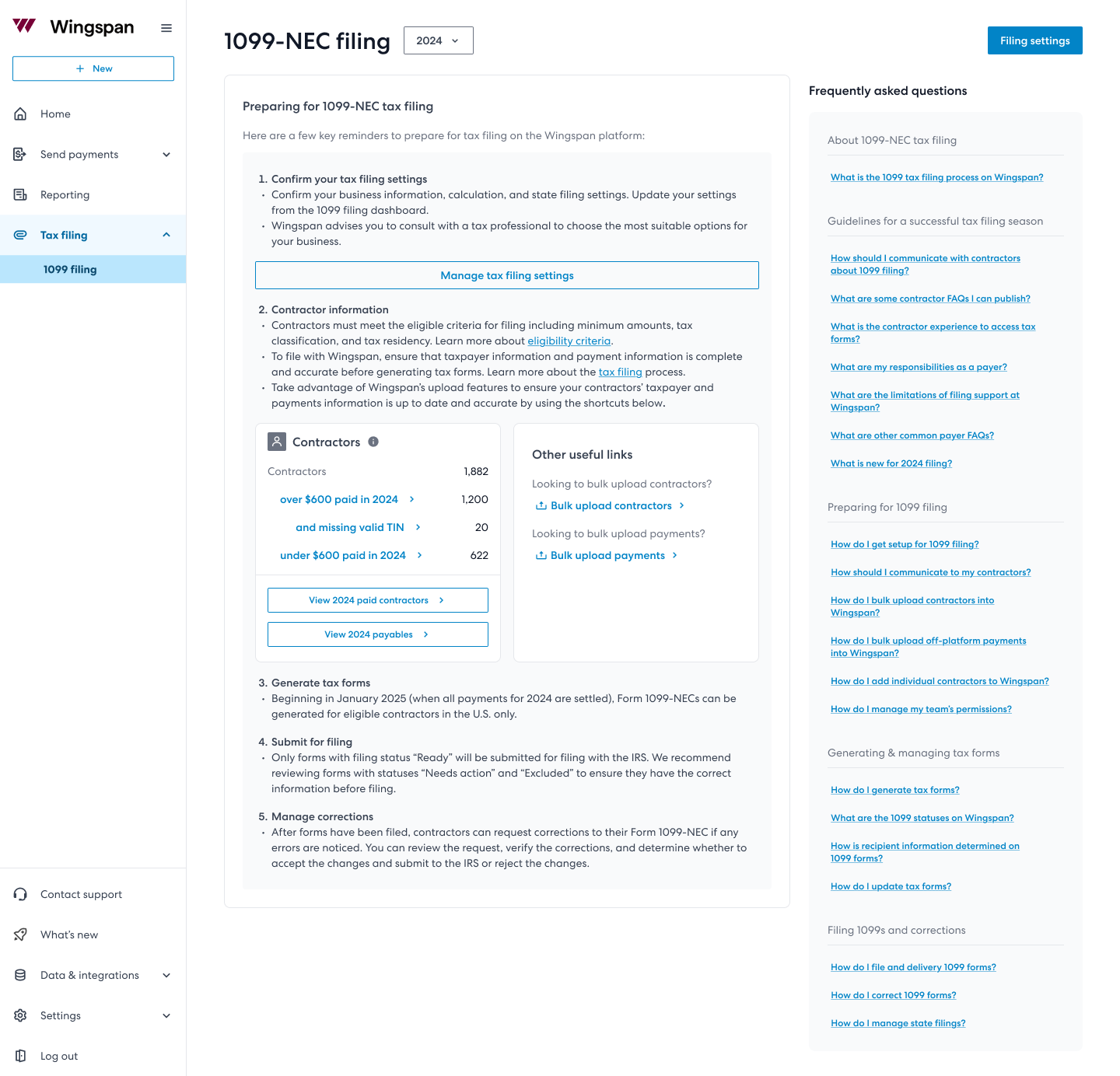

- Navigate to Tax Filing → 1099 forms from your dashboard.

- Click Filing settings (or Manage tax filing settings) to open the configuration flow.

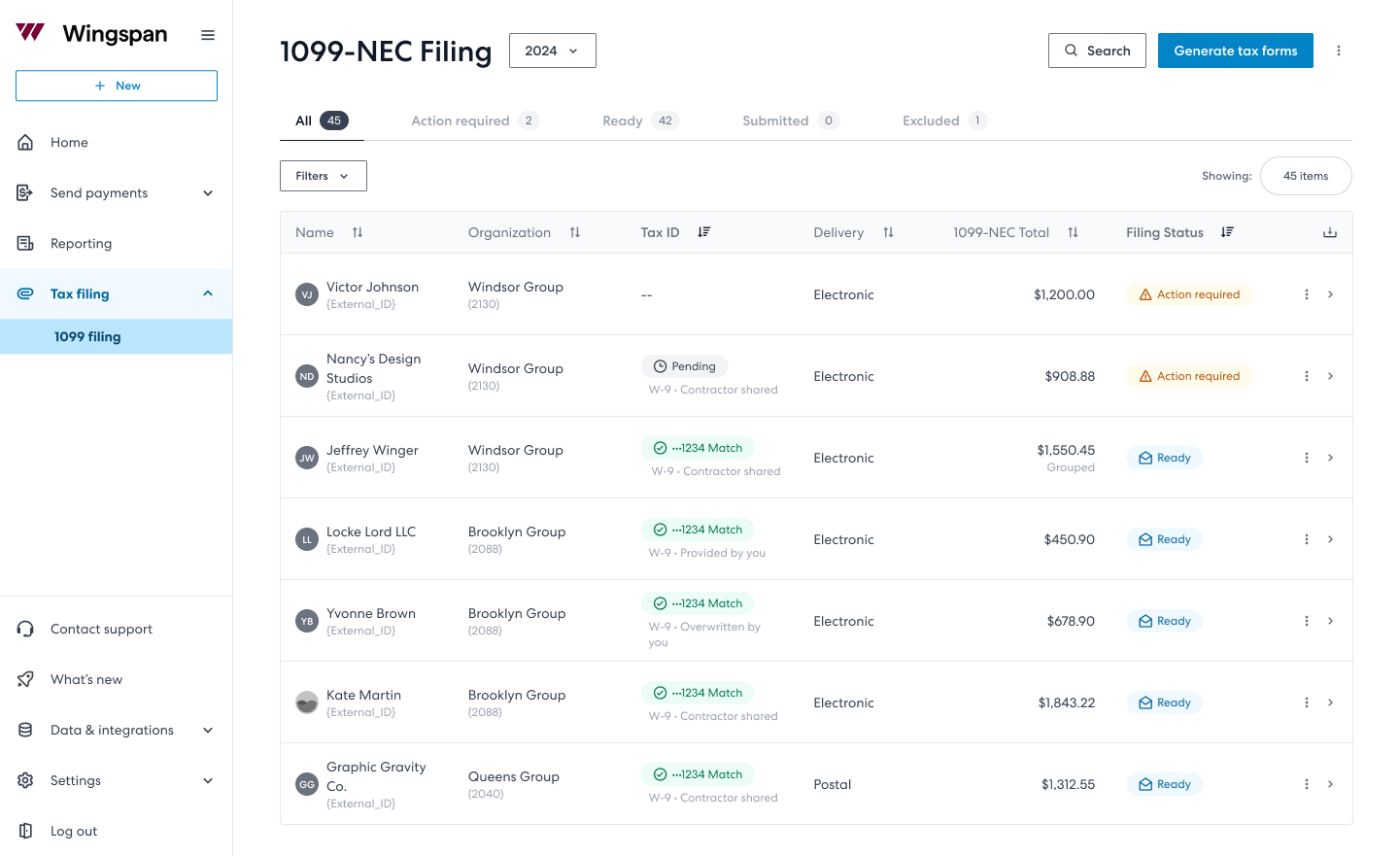

1099 filing dashboard screenshot

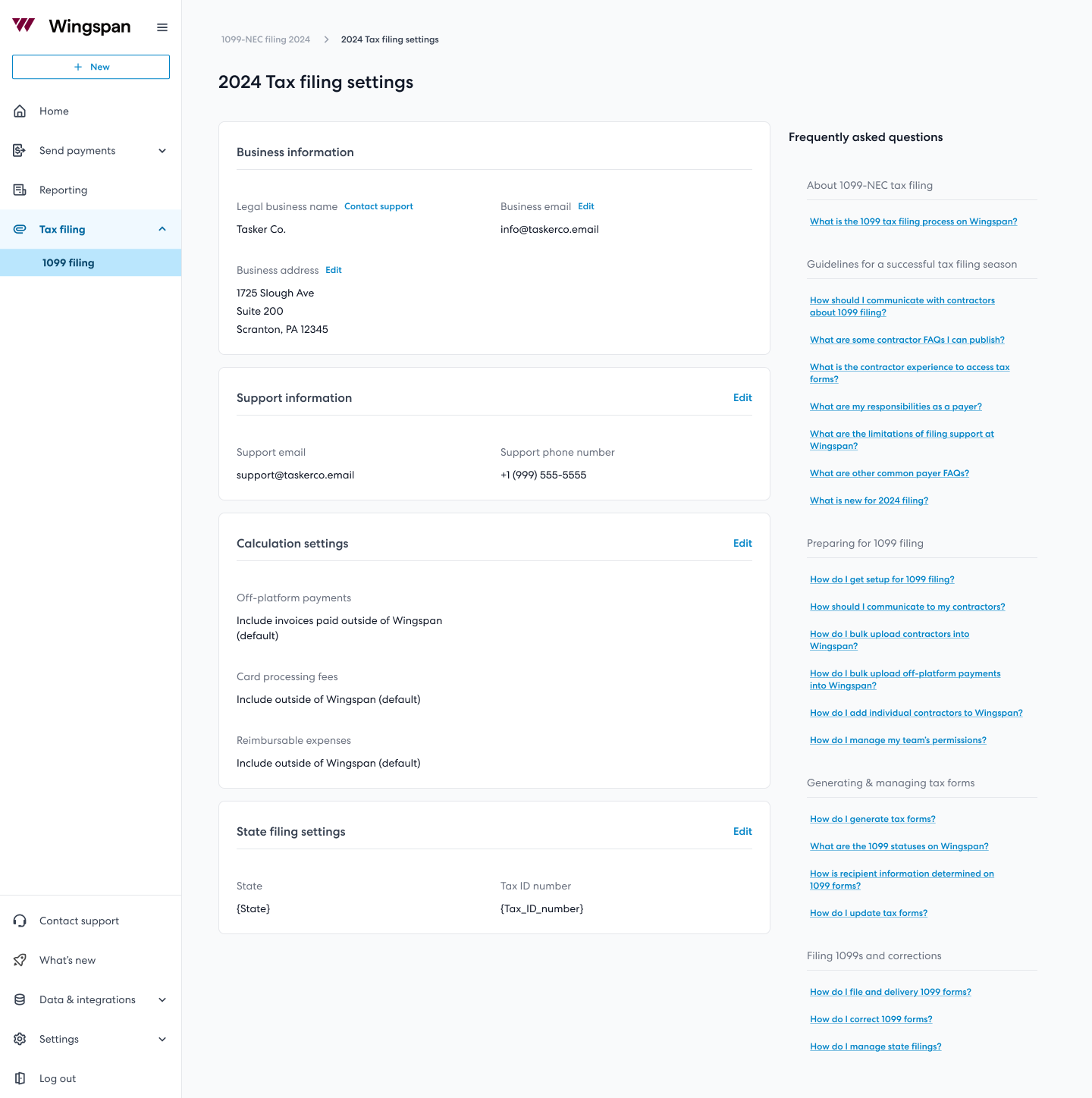

Step 1: Verify Payer Information

- Review the business information that will appear on every 1099.

- Update incorrect details and confirm your support contact information so contractors know how to reach you when issues arise.

Support contactsSupport contact information is visible to contractors and is used by Wingspan support when an inquiry needs to be escalated. The support phone number you provide appears in the payer section of each form.

Tax filing settings screenshot

Note on sub-organizationsIf a contractor is associated with a sub-organization, their 1099 will display the payer as

[Primary Organization Name] FBO [Sub-Organization Name].

Step 2: Choose the 1099 Form Type

Decide whether you will file Form 1099-NEC or Form 1099-MISC (Box 6: Medical and health care payments) for the current payer entity. Wingspan only supports Box 6 when filing 1099-MISC forms.

- 1099-NEC: Report non-employee compensation.

- 1099-MISC (Box 6): Report medical and health care payments. When selected, you must confirm that all payments being included belong in Box 6.

You can change the selected form type before generating amounts if your filing needs evolve.

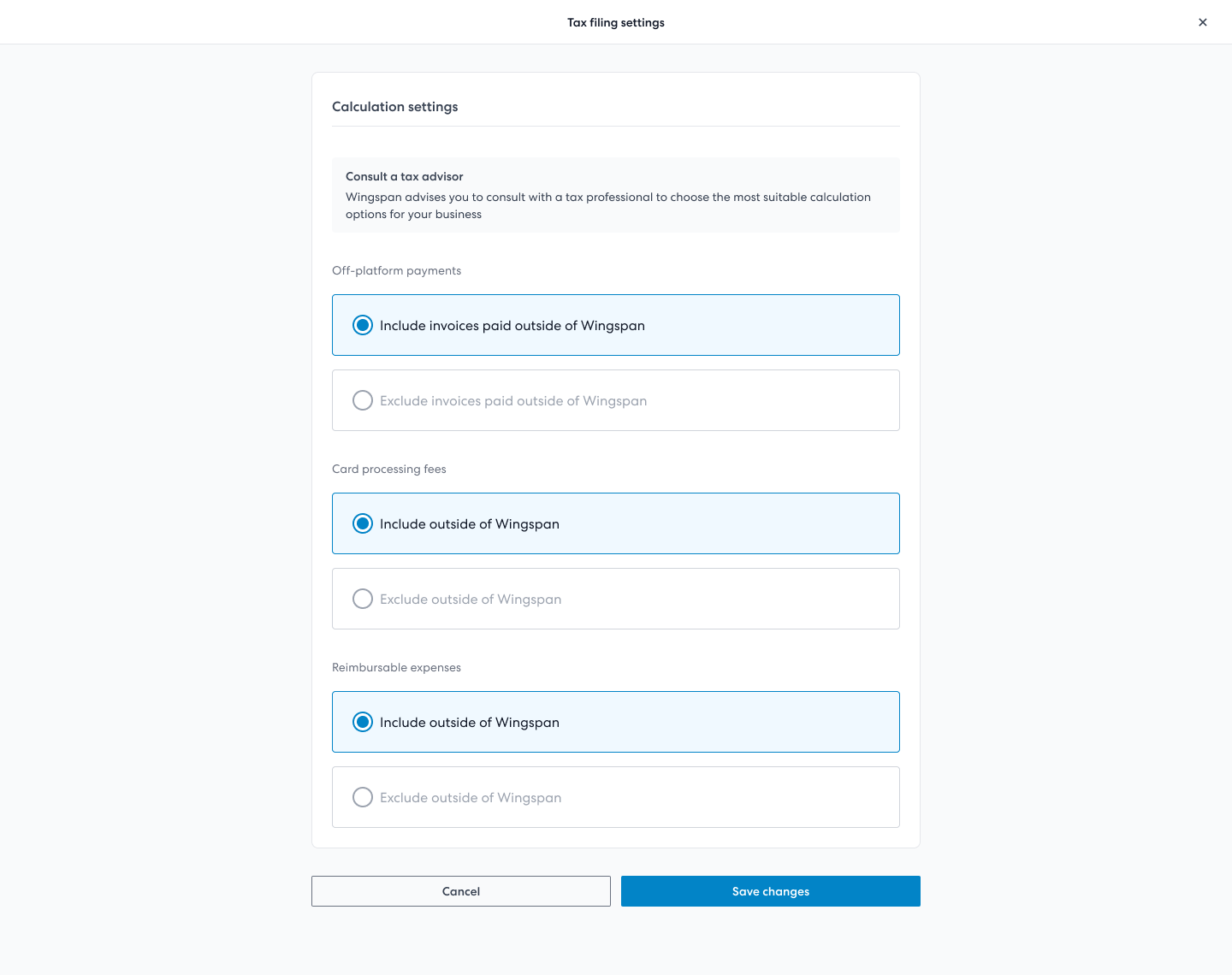

Step 3: Configure Payment Calculations

Choose how Wingspan calculates amounts for the form type you selected.

- Off-platform payments: Include invoices marked as paid outside of Wingspan.

- Card processing fees: Decide whether to add debit/credit card fees to the 1099 total.

- Reimbursable expenses: Choose to include or exclude these line items.

Calculation settings screenshot

Consult a tax advisorConsult your tax advisor to confirm which payment categories belong on your 1099-NEC or 1099-MISC (Box 6) forms.

Payment date recognitionWingspan uses the payment completion date to determine which tax year a payment belongs to.

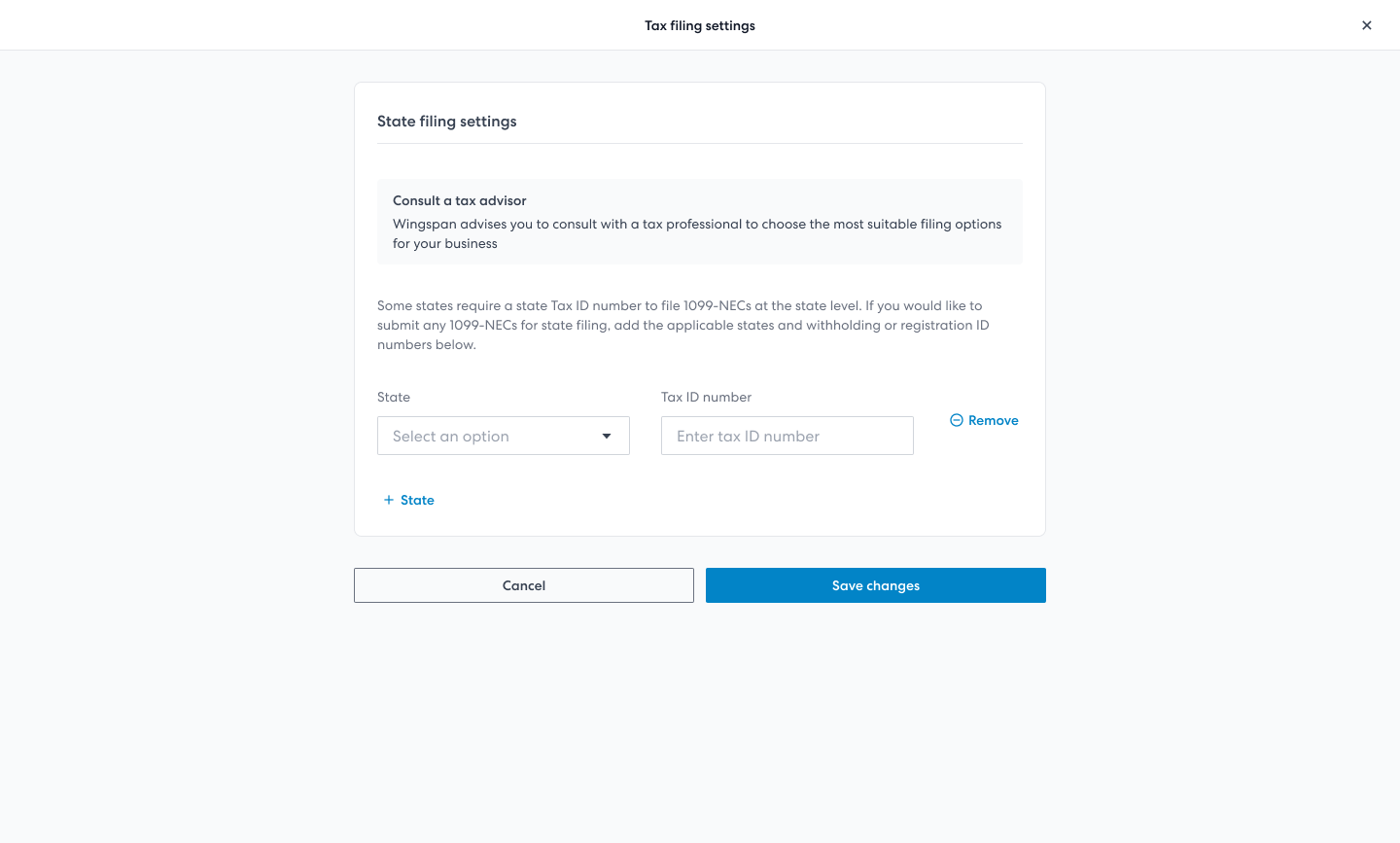

Step 4: Manage State Filing Requirements

Wingspan identifies states that require filing based on contractor addresses. State tax IDs can be stored for each payer, but they are not transmitted during 2025 filings.

State filing settings screenshot

About state-level tax IDs

State IDs will not appear on PDFs or be transmitted to state agencies during the

2025 season. Capturing them now prepares you for future functionality.

Step 5: Review Contractor and Payment Information

After configuring settings, review contractor records and payments to ensure you are ready to generate forms starting January 17, 2026 (after all 2025 payments have settled).

Bring your contractor data into Wingspan

- Use Bulk upload contractors to invite contractors at scale.

- Use Bulk upload payments to include off-platform payments.

- Use Add individual contractor when adding one contractor at a time.

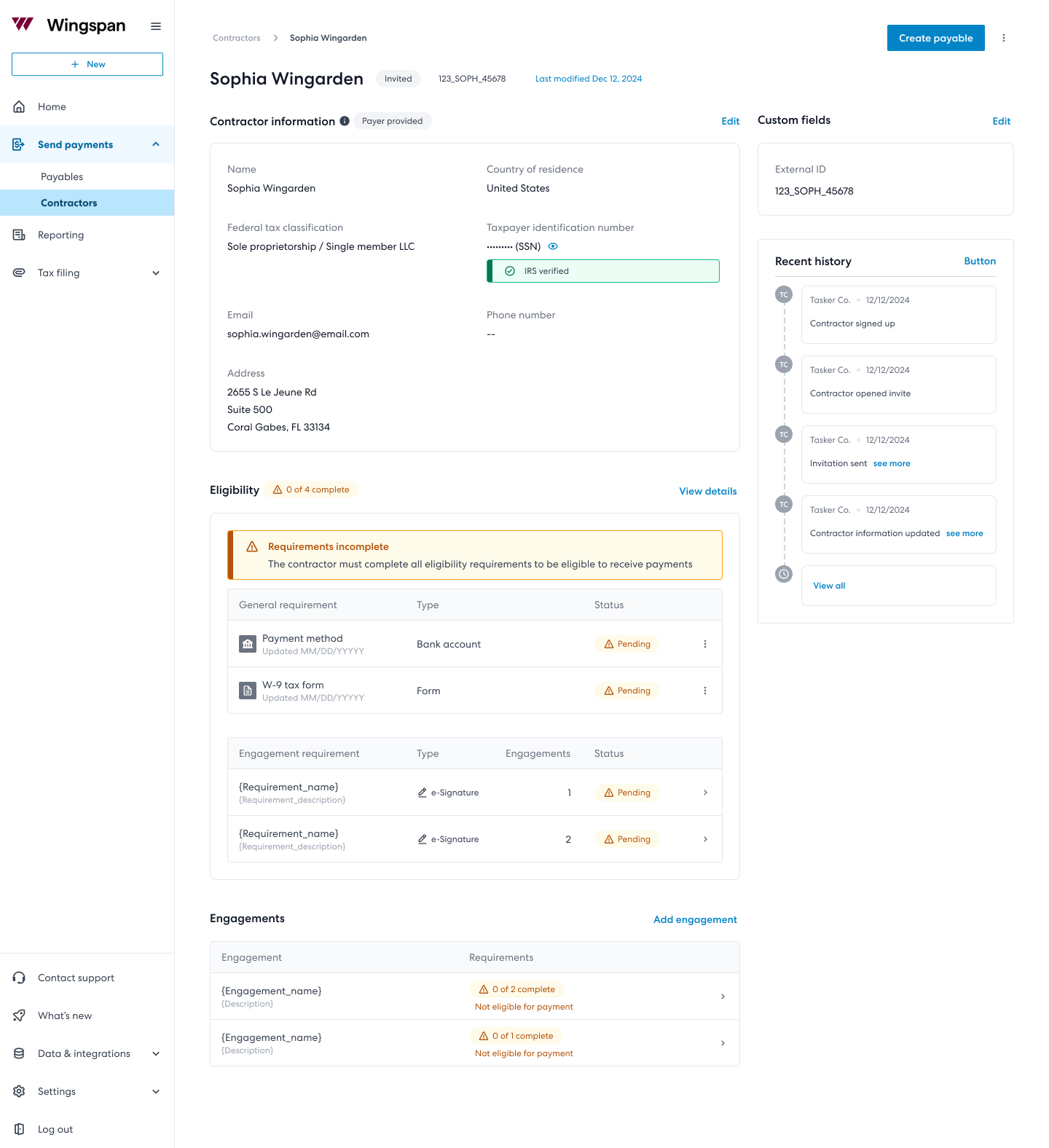

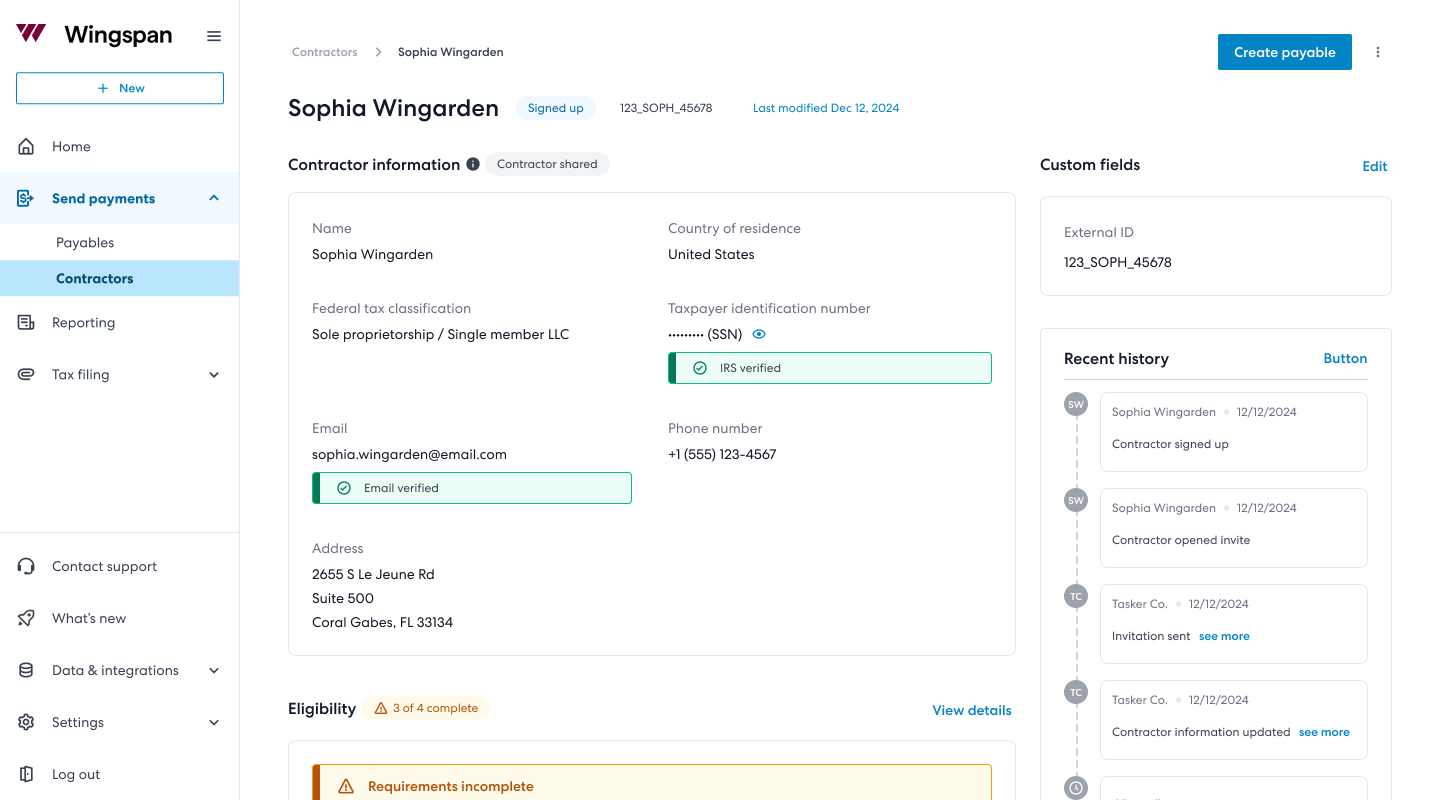

Managing the contractor lifecycle

- After you add a contractor (individually or via bulk upload), the profile is populated with your provided information, including optional W-9 details.

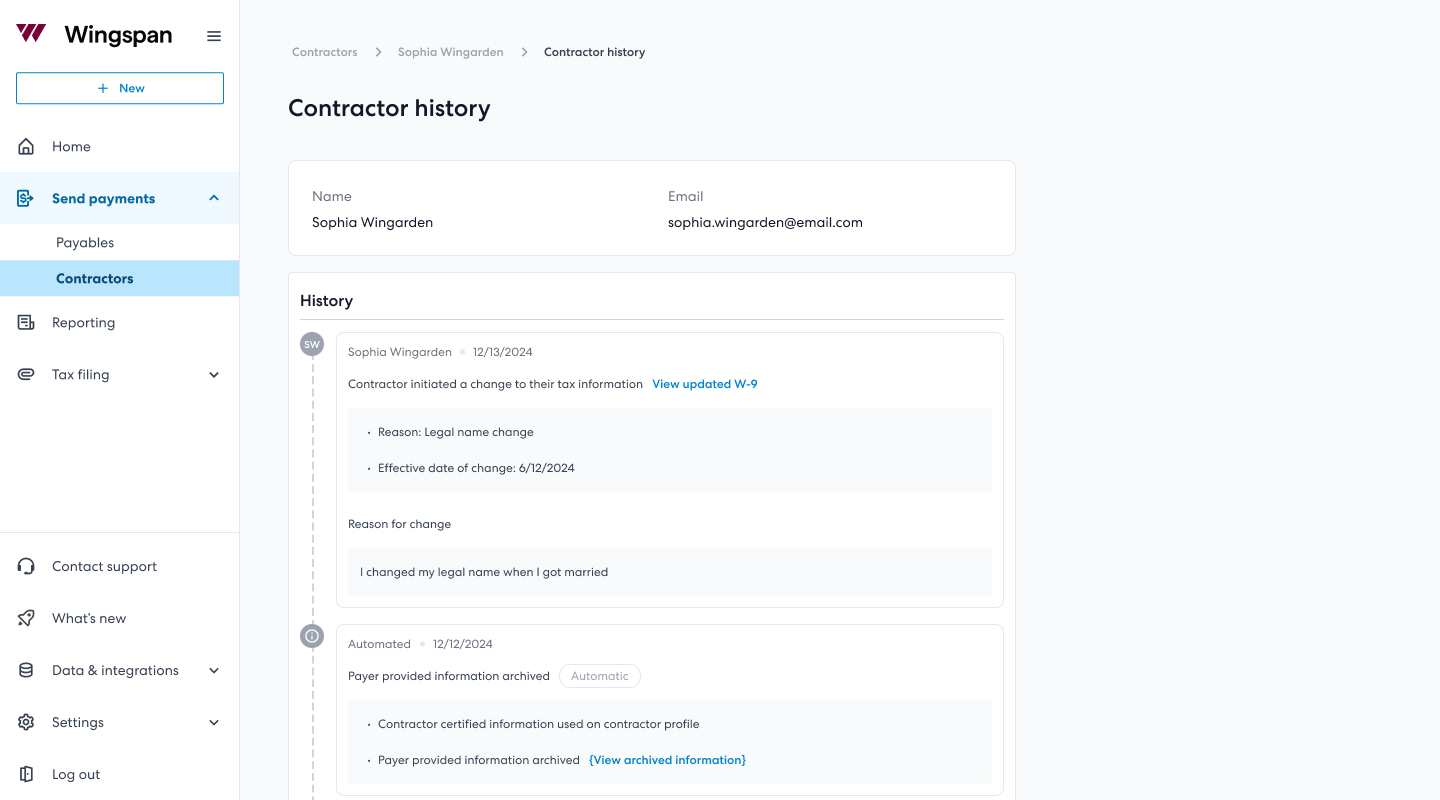

- Once a contractor verifies their data, Wingspan synchronizes the contractor profile with their certified information. Payer-provided details are archived for reference.

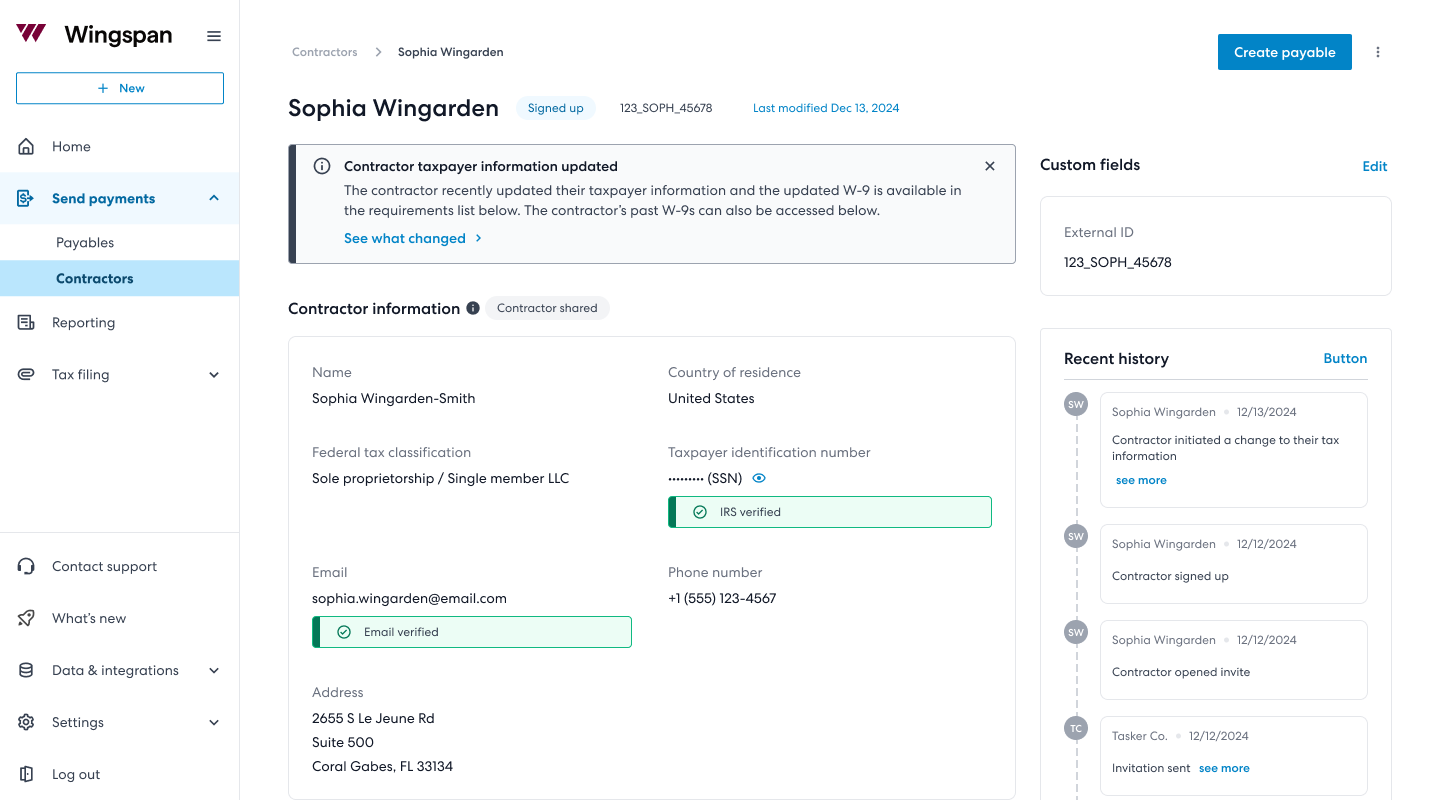

- When contractors update information, you receive notifications on the contractor profile.

Step 6: Preview & Generate Tax Forms

When generation opens on January 17, 2026 you will see:

- A consolidated list of generated 1099s with form type and amount.

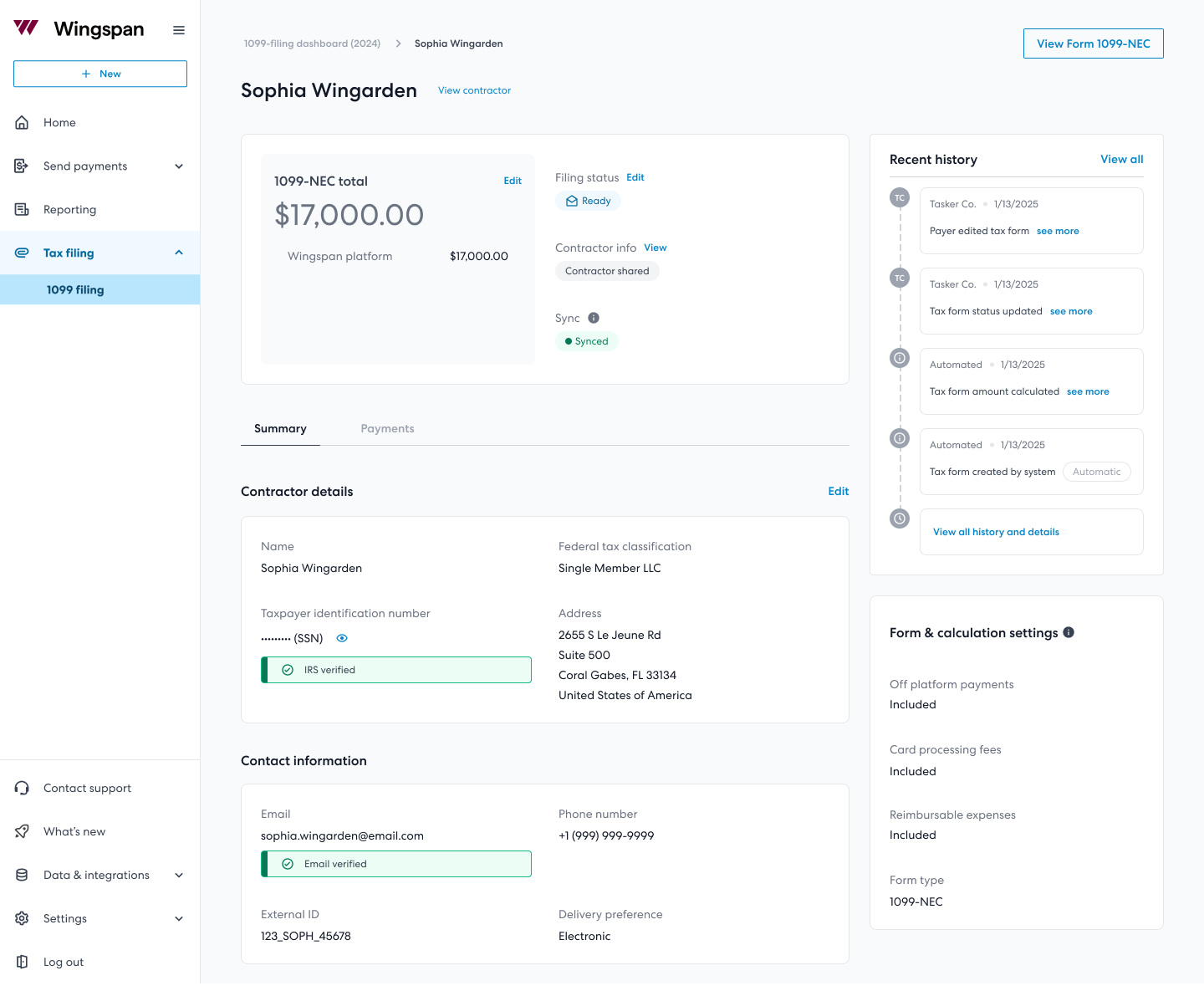

- Detailed views for each 1099 that include payer data, contractor data, and the calculated total.

Updated 5 months ago