File & Deliver Your 1099s

File 1099-NEC or 1099-MISC (Box 6) forms with federal and state authorities and deliver copies to your contractors with Wingspan.

Prerequisites

Key filing dates:

- January 20, 2026: File your tax forms via Wingspan by this date to meet IRS timelines. (Recommended)

- January 25, 2026: Final date to e-file 1099 forms using Wingspan for the 2025 season.

1099 filing permissions:

- Only users with Administrator access can file 1099s

Submit for filing:

- Review the tax forms for accuracy and click Submit for filing by Jan 25. Wingspan will do the rest.

- Ensure every form (1099-NEC or 1099-MISC Box 6) is complete and accurate. Forms should display Ready if the TIN is verified and the filing threshold is met.

- For details on 1099 filing statuses, refer to Understanding 1099 Statuses.

- Wingspan supports 1099-MISC filings for Box 6 (medical and health care payments) only.

IRS 1099 deadlinesThe IRS filing deadline for both 1099-NEC and 1099-MISC (Box 6) is January 31, 2026. Penalties may apply if filings occur after the due date.

See other key dates for 1099 filing with Wingspan.

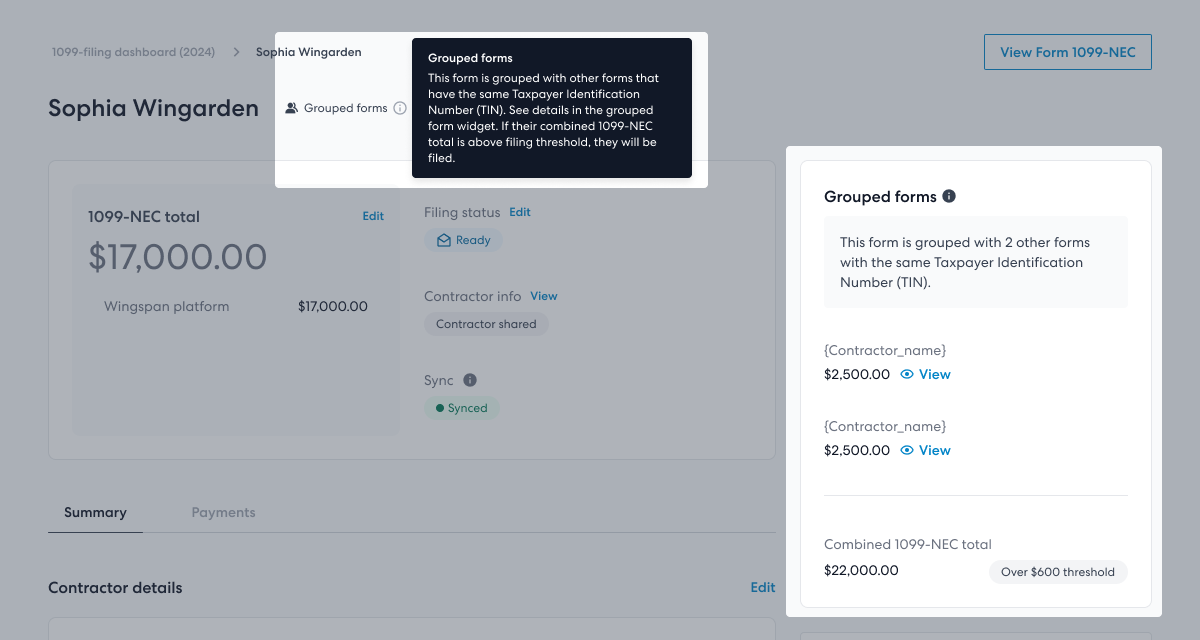

Combined eligibility (contractors share the same TIN)

Contractors with the same TIN are aggregated together when determining filing eligibility.

Normally, if a contractor receives less than the federal $600 threshold, they are excluded and their 1099 details page for the year receives an Excluded status label.

However, contractors who share a TIN can be eligible even if an individual form is below $600. When combined compensation exceeds the threshold, each form is marked Ready (assuming all other eligibility criteria are met). The grouped forms widget shows the aggregated total so you can confirm the combined eligibility.

Grouped forms label on the contractor's 1099 details page (screenshot example).

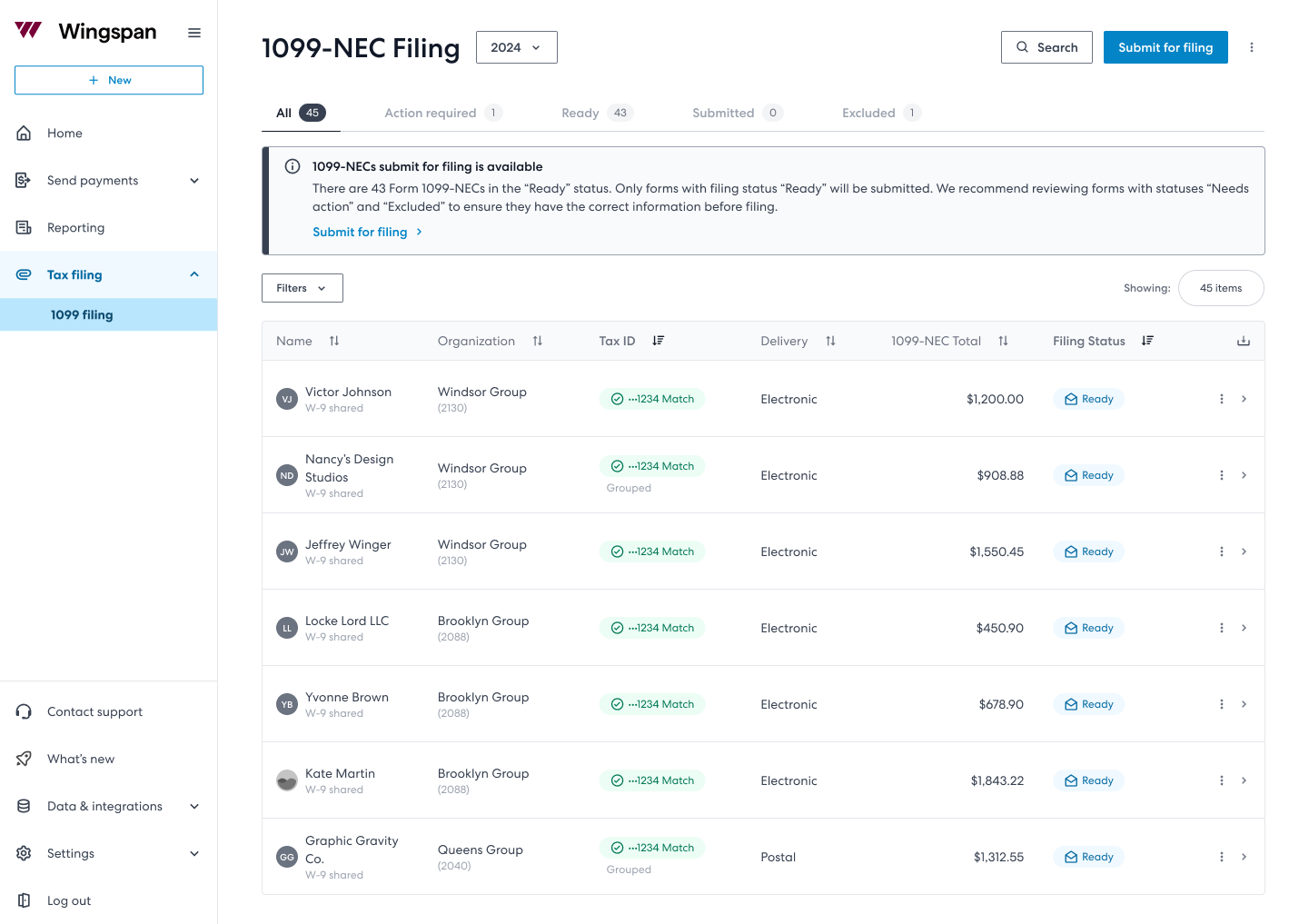

File your tax forms

Forms will be submitted to the IRS for federal filing and applicable state filing at the same time. Currently, there is no option to file forms with the IRS and States separately. Confirm your state filing information is up-to-date using the dashboard actions. The states where the 1099s are filed will be based on where the contractor's address is located.

When you're ready to file, check the Ready forms one last time. All forms labeled Ready are automatically filed when you click on Submit for filing from the 1099 filing dashboard and complete the filing process.

Submit for filing (screenshot example)

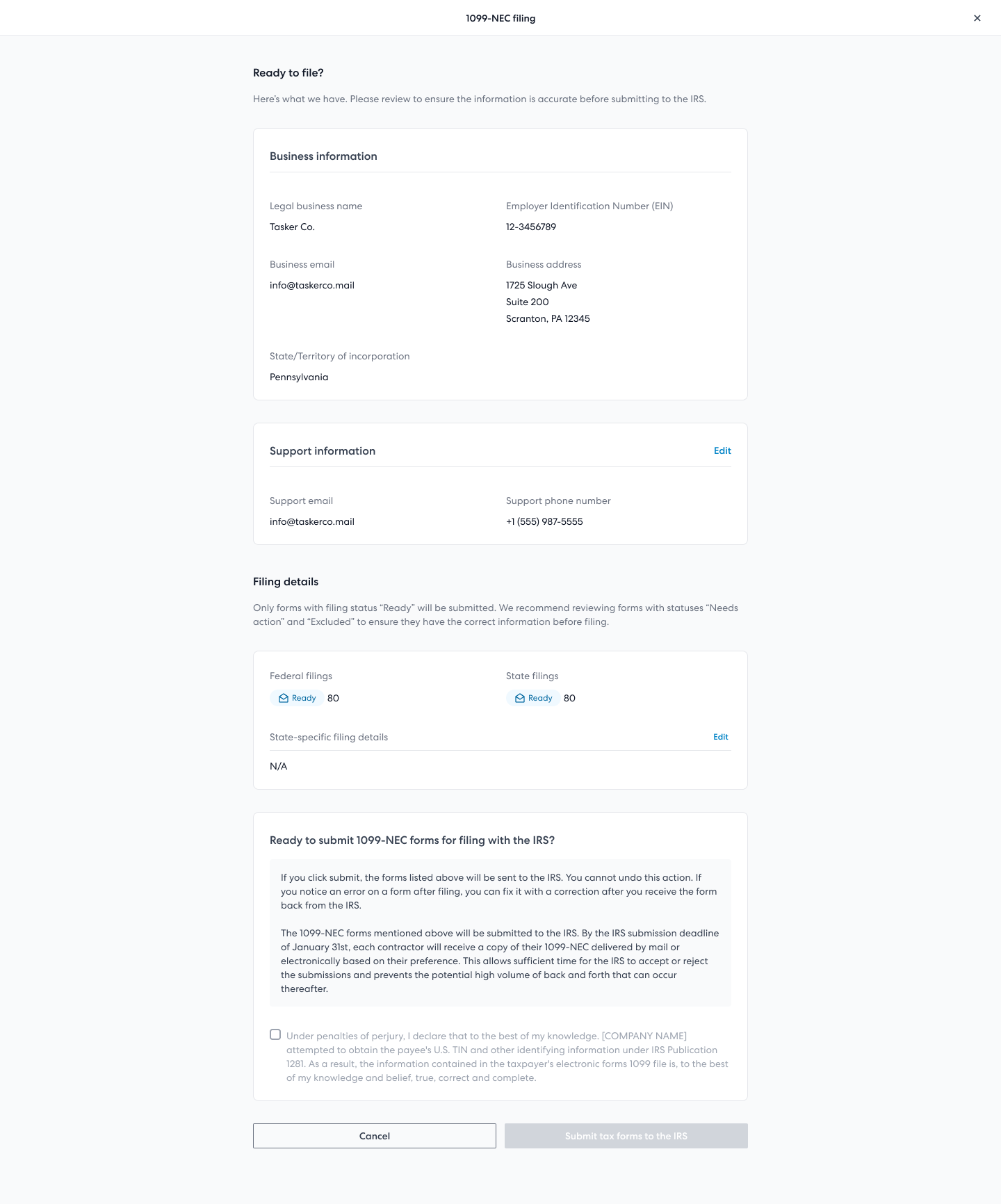

First, confirm your payer information. To change your payer information, click Edit on the top right. If you make changes, your information will also be updated on your Tax Profile under Settings in the main menu. If you submit forms with incorrect payer information, the IRS requires you to mail a letter with the revisions.

Once your information is correct, accept the legal declaration (a standard IRS penalty of perjury statement) and click the Submit tax forms button to submit your tax forms for automatic filing with the IRS.

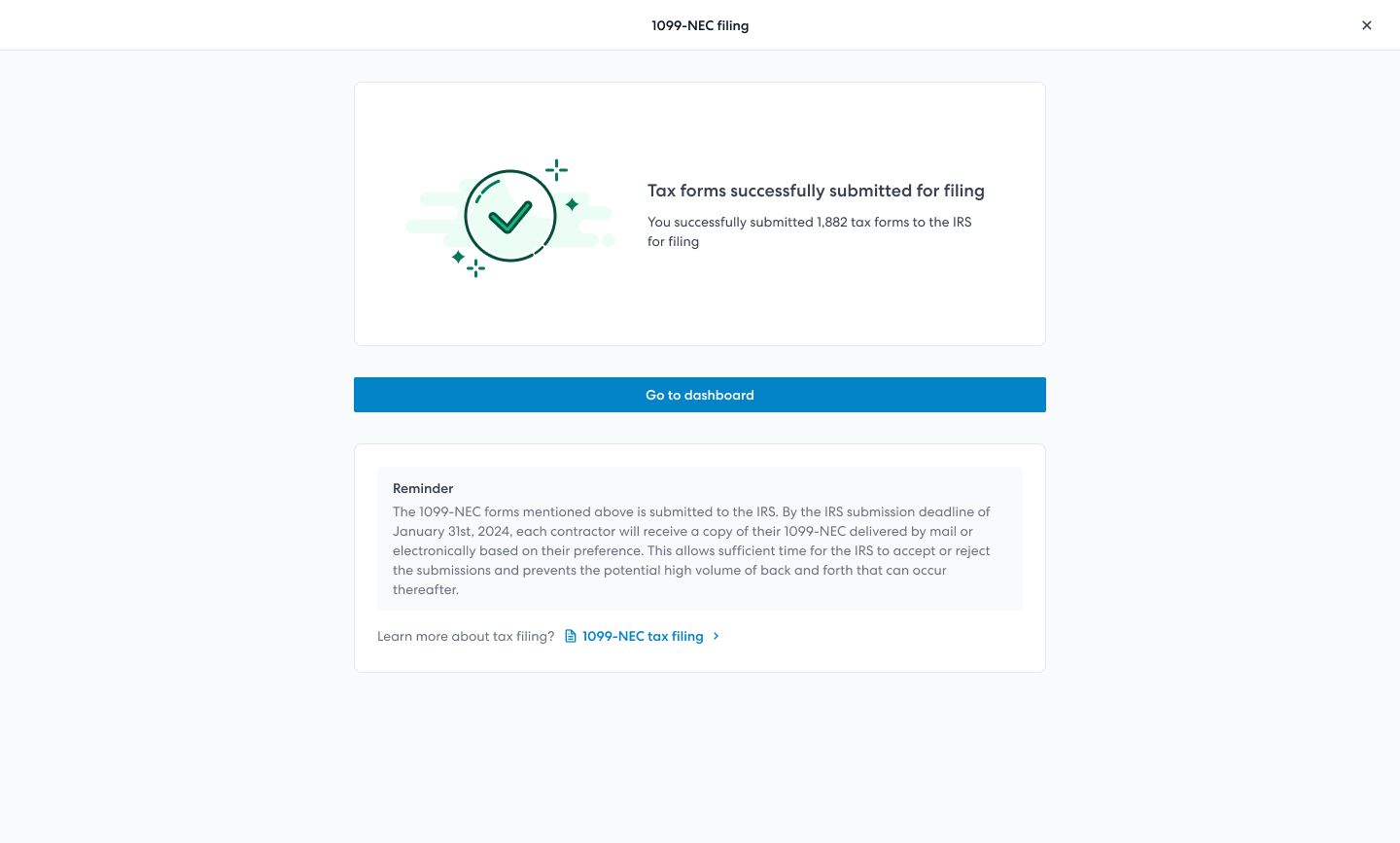

After you click submit tax forms, a success message displays.

Submit tax forms (screenshot example)

Tax form submission success (screenshot example)

Delivery of 1099 forms

After you submit all the forms for filing, the submitter will receive an email confirmation that the forms were submitted. You can access and download a copy of the filed forms from the contractor's 1099 detail page which can be accessed by clicking on a contractor from the 1099 dashboard.

The contractors who have signed up for Wingspan and consented to receive an electronic copy of the 1099 will receive their form through the Wingspan App. Wingspan sends an email notification to the contractor to provide access to the electronic copy of the form.

Contractors who have not consented for electronic delivery or who have not completed Wingspan's sign-up at the time of filing will have their 1099 delivered through postal mail based on the address on the tax form.

You can track the delivery status of 1099 forms on the dashboard.

Limited 1099 Access for Contractors with Payer-Uploaded W-9sContractors whose W-9 information was uploaded directly by payers to Wingspan (rather than submitted through Wingspan's onboarding) cannot access their tax forms or request corrections through the platform. This restriction exists because there is no secure authentication link between the contractor's two-factor authentication and their W-9 information that was uploaded by the payer. This security measure prevents potential exposure of sensitive tax information in cases where payer-provided email addresses might be incorrect or mismatched.

Organizations with multiple organization accounts

If you are using organization accounts, the filing behavior depends on

For example, the payer information that is displayed to contractors will be:

-

Submitting Filings from the Root Organization Account

When you select "Submit for filing" while logged in with root organization credentials, the system will automatically process tax filings for both the primary organization account and all associated sub-organization accounts. This comprehensive submission ensures that each tax form includes the root organization's Employer Identification Number (EIN) and its legal business name as the payer information. This method ensures that all entities under the root organization are covered in a single submission process.

-

Submitting Filings from an Edge Organization Account

Selecting "Submit for filing" from an edge organization account—any sub-entity within your organization's account structure—initiates the filing process exclusively for that account. The tax forms submitted in this manner will feature the edge account's specific payer information, including its EIN and legal business name. This method isolates the filing to the edge account, ensuring that information from the root organization account is not included.

-

Root Organization Filings with Sub-Organization Name Inclusion

Activating this feature allows tax filings submitted from the root organization account to include a designation for the benefit of (FBO) sub-organization accounts. This means the tax forms will list the root organization's EIN and legal business name, followed by the sub-organization's legal business name, indicating the filing covers both entities.

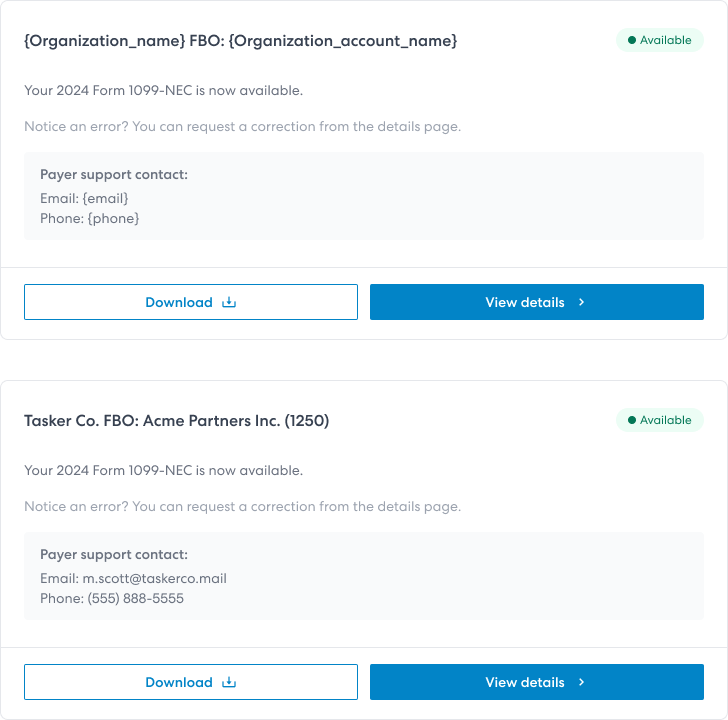

- The format used is: {Root Organization Name} FBO {Sub-Organization Name}

- For example, if the root organization is "Tasker Co." and the sub-organization account is "Acme Partners Inc. (1250)", the payer name on the form will appear as Tasker Co. FBO Acme Partners Inc. (1250).

To enable this feature, please contact your account manager directly.

Contractor's tax document dashboard (screenshot examples)

Form statuses and action required

The IRS will either accept or reject the submitted forms. Once a filing has been submitted, the IRS will typically respond in one (1) business day.

Accepted - No further action is needed. You and the contractor will have access to download forms from your respective 1099 dashboards and detail pages. You can file a correction should any errors surface after an accepted filing.

Rejected - The rejected 1099s will revert to a Action required status with any missing or errors to be addressed until it is ready to be resubmitted again to the IRS.

For details on all 1099 filing statuses, refer to Understanding 1099 Statuses.

Data Length Limitations

When submitting contractor information to Wingspan, you have a standard character limit of 191 characters for most form fields (including names, addresses, and cities). However, different parts of our system handle data lengths differently depending on their purpose.

General Guidelines for Data Submission

Do not truncate or shorten any data before submitting it to Wingspan. We handle any necessary adjustments internally, and full-length data may be important for electronic filing or other government submissions, even if it doesn't appear fully on PDFs or physical mailings.

TIN Verification Limits

For TIN verification purposes, Wingspan uses only the first 70 characters of the name field. For best results with TIN matching:

- Avoid including middle names in the name field

- Focus on the legal first and last name

PDF Form Display

When rendering PDFs, Wingspan handles long text by:

- Wrapping text onto new lines where possible

- Preserving all data without truncation

Physical Mailing Limitations

For physical mailings, Wingspan enforces the following character limits to ensure proper delivery:

| Field | Maximum Length |

|---|---|

| Name | 40 characters |

| Secondary Name | 40 characters |

| Address | 64 characters |

| Address Line 2 | 64 characters |

| City | 200 characters |

| State | 2 characters |

| ZIP Code | 5 characters |

Physical mailings are limited to US addresses only.

Physical Mail Delivery Tracking

Wingspan monitors mail delivery through USPS scanning events to keep track of your contractors' 1099 forms and other tax documents. Here's what you need to know about mail delivery tracking:

USPS Scanning Events

While Wingspan receives scanning updates from USPS to track mail status, please note that:

- USPS does not guarantee that all scanning events will occur

- Scanning events may not always happen in sequential order

- Some deliveries may not generate a final delivery scan

How Wingspan Handles Delivery Status

To provide reliable tracking despite these USPS limitations:

- We monitor and analyze all available USPS scanning events

- We normalize inconsistent scanning data to show logical status progression

- For mailings without an explicit USPS delivery confirmation, we automatically mark items as "Delivered" after 6 business days (the standard USPS First Class Mail delivery window)

Delivery Timeframes

- Standard delivery time for domestic First Class Mail: 4-6 business days

- Wingspan marks mail as delivered after 6 business days, even without explicit USPS confirmation

- You can view delivery status updates in your dashboard's mailing history

Updated 5 months ago