Communication Timeline & Guide

Review Wingspan’s communication to your contractors, and additional recommended communication Wingspan recommends you send.

Wingspan recommends reviewing and updating (as needed) the following communication timeline. Preparing your contractors for messages from Wingspan helps to make a smoother experience during tax season. This guidance applies to both 1099-NEC and 1099-MISC (Box 6) filings.

| Sender | Date | |

|---|---|---|

| You | Email template: pre-Wingspan email Subject: Our tax partner Wingspan will be sending you an important email | Before December 23rd |

| Wingspan | Wingspan Automated Email: Tax information confirmation Subject (existing contractors): Wingspan needs you to verify your tax details Subject (new contractors): [Your Company] invited you to provide your tax info via Wingspan | December 23rd to January 13th |

| You | Email template: follow-up reminder Subject: Action Needed: Verify Your Tax Information via Wingspan | January 13th |

| Wingspan | Wingspan Automated Email: 1099 is filed Subject: Your 1099 tax form is ready | When you file your 1099s |

Your communications

1. Email template: pre-Wingspan email

We recommend letting your contractors know that they'll be receiving information about their 1099 tax forms from Wingspan. We've found that introducing your contractors to Wingspan helps with email engagement and builds trust for requests for tax information.

Email template:Subject: Our tax partner Wingspan will be sending you an important email

Pre-header: Confirm your information with Wingspan

Email body: has teamed up with Wingspan to manage the 1099 tax forms that document your earnings. Between December 23rd and January 13th, expect an email from Wingspan ([email protected]) that will guide you through confirming your tax details and how you'd like to receive your 1099 form.

Next Steps:

- Watch for an email from Wingspan ([email protected]) and click the link inside

- If you're new to Wingspan: Create an account and provide your tax information

- If you already have a Wingspan account: Review and confirm your existing tax information

Helpful Tips:

- Add [email protected] to your address book to prevent the email from going to spam

- You'll receive both an email and in-app notification if you already have a Wingspan account

FAQs:

- What is a 1099 form? It's a tax document that summarizes your earnings if you're an independent contractor and you've earned $600 or more in 2025. Both you and the IRS receive a copy.

- Why confirm my information? We need to validate your details to ensure that the 1099 form is accurate and delivered correctly.

- When will I get my 1099 form? If you meet the minimum income requirements ($600+), expect to receive a link to download your 1099 form when filed, usually by February 1st. A paper form is also available upon request.

2. Email template: follow-up reminder

We recommend sending a follow-up to contractors who haven't yet confirmed their tax information. Below is a proposed email template you can customize:

Email template:Subject: Action Needed: Verify Your Tax Information via Wingspan

Pre-header: Important steps to ensure you receive your accurate 1099 tax form

Email Body:

Email Body: has partnered with Wingspan to manage your 1099 tax forms. You should have received an email from Wingspan ([email protected]) with instructions to confirm your tax details.

What to Do Next:

- Check your email (including spam folder) for a message from Wingspan

- Click the secure link provided

- For new users: Create your Wingspan account and provide your tax information

- For existing users: Review and confirm your current tax information

Important Notes:

- This confirmation process is required for all US-based contractors who earned $600+ in 2025

- If no action is taken by the time your payer submits tax forms to the IRS, existing information on file will be used

- Both email and in-app notifications have been sent to existing Wingspan users

For help, contact Wingspan support.

Wingspan's communications

1. Wingspan Automated Email: Tax information confirmation

Subject for existing contractors: [Your Company] needs you to verify your tax details

Subject for new contractors: [Your Company] invited you to provide your tax info via Wingspan

Sender: [email protected]

Invite timing and criteriaWingspan distributes tax confirmation requests between December 23rd and January 13th to eligible contractors who meet these criteria:

- US-based contractor

- Received payments > $600 in the tax year

- Not archived

- Associated with a payer who has enabled 1099 experience

- Has not otherwise updated their name or tax ID since September 1st of the tax year

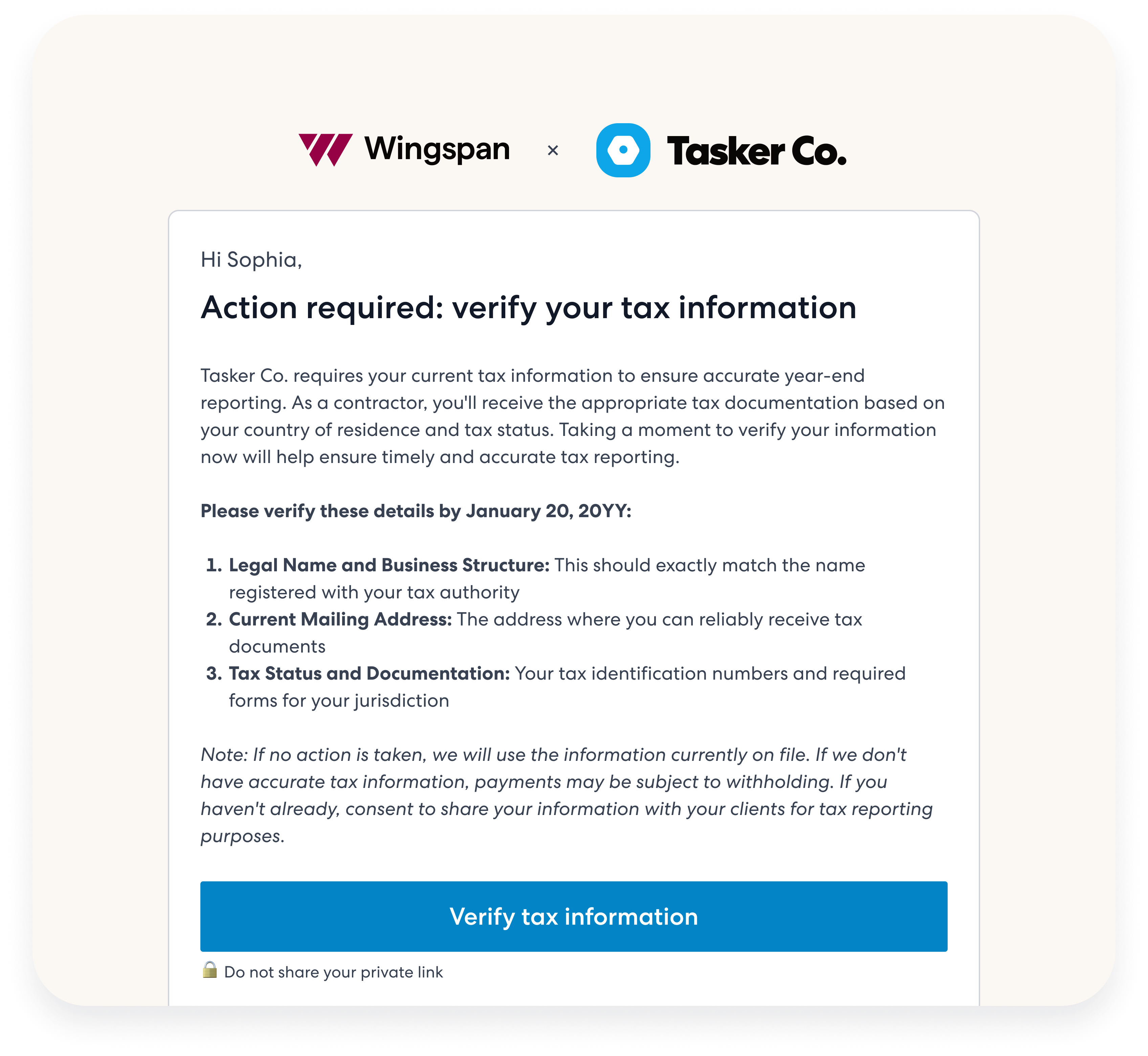

Confirmation email for contractors who have already provided their tax information via Wingspan

Contractor Experience

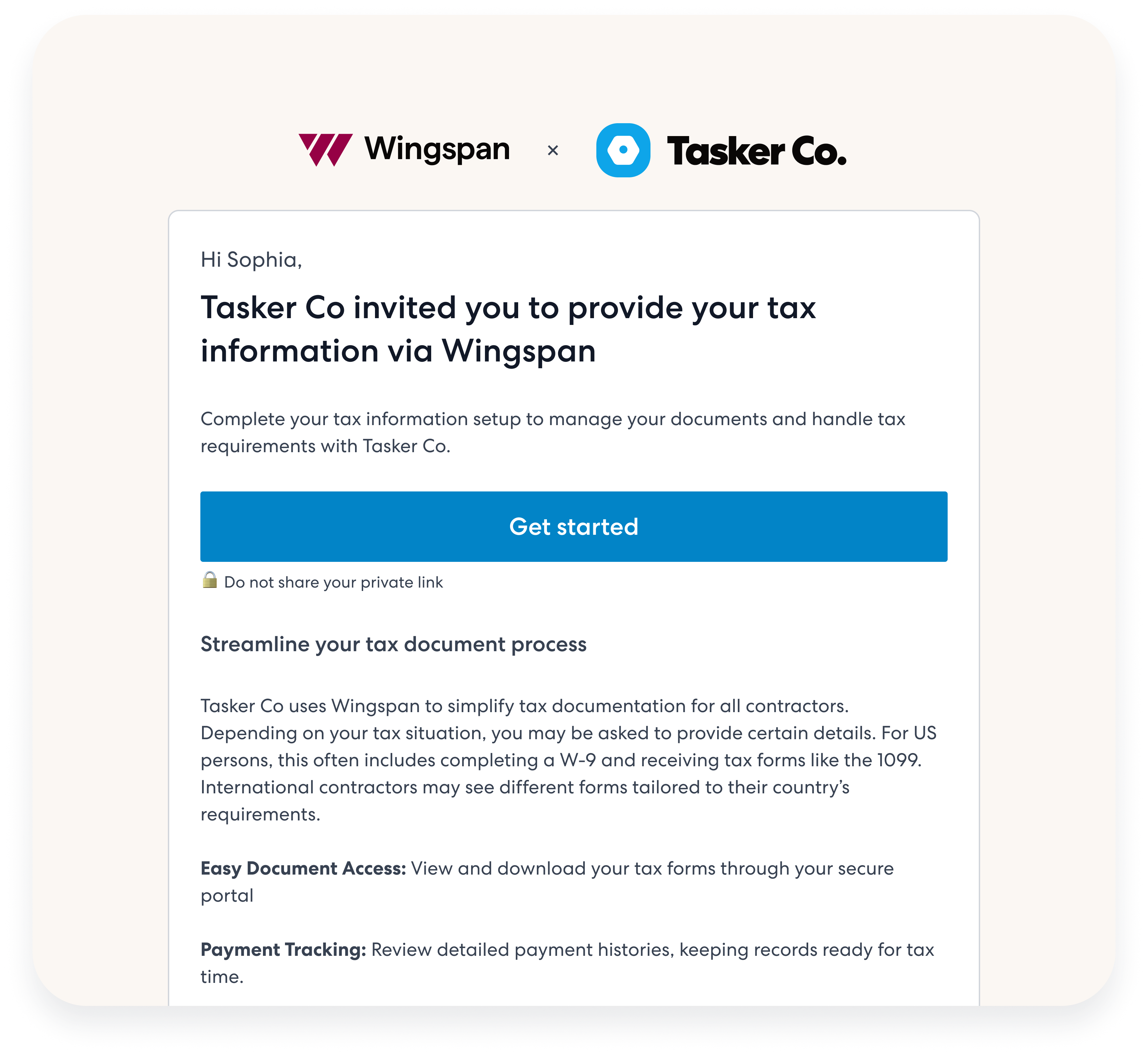

- New contractors will be invited to sign up for a Wingspan account and provide their tax information

- Contractors with an existing Wingspan account will be prompted to review and confirm their current tax information

- Both email and in-app notifications will be sent to existing users

- If no action is taken by January 13th, existing information on file will be used for tax forms

Invite email for contractors who have not yet provided their tax information via Wingspan

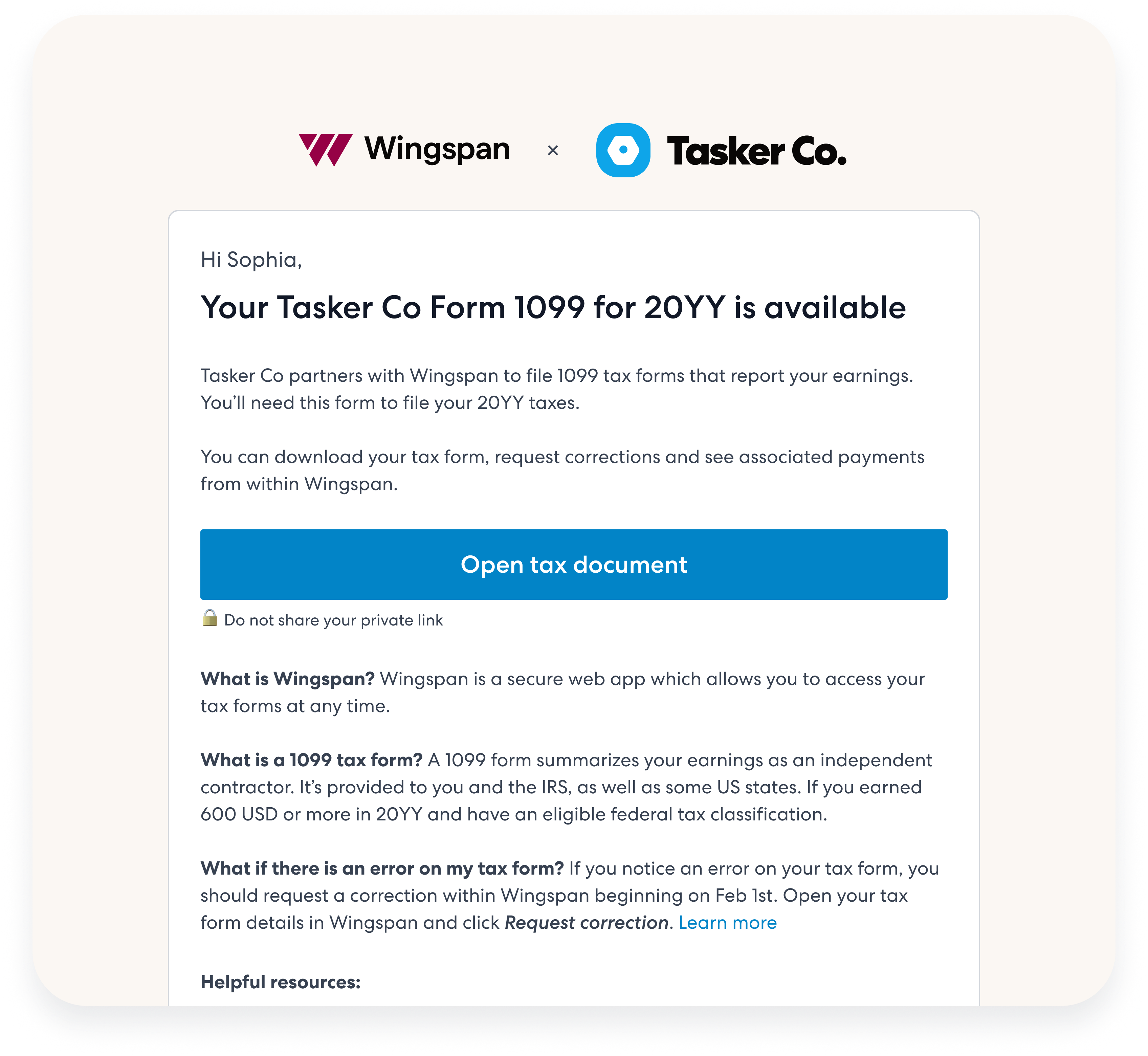

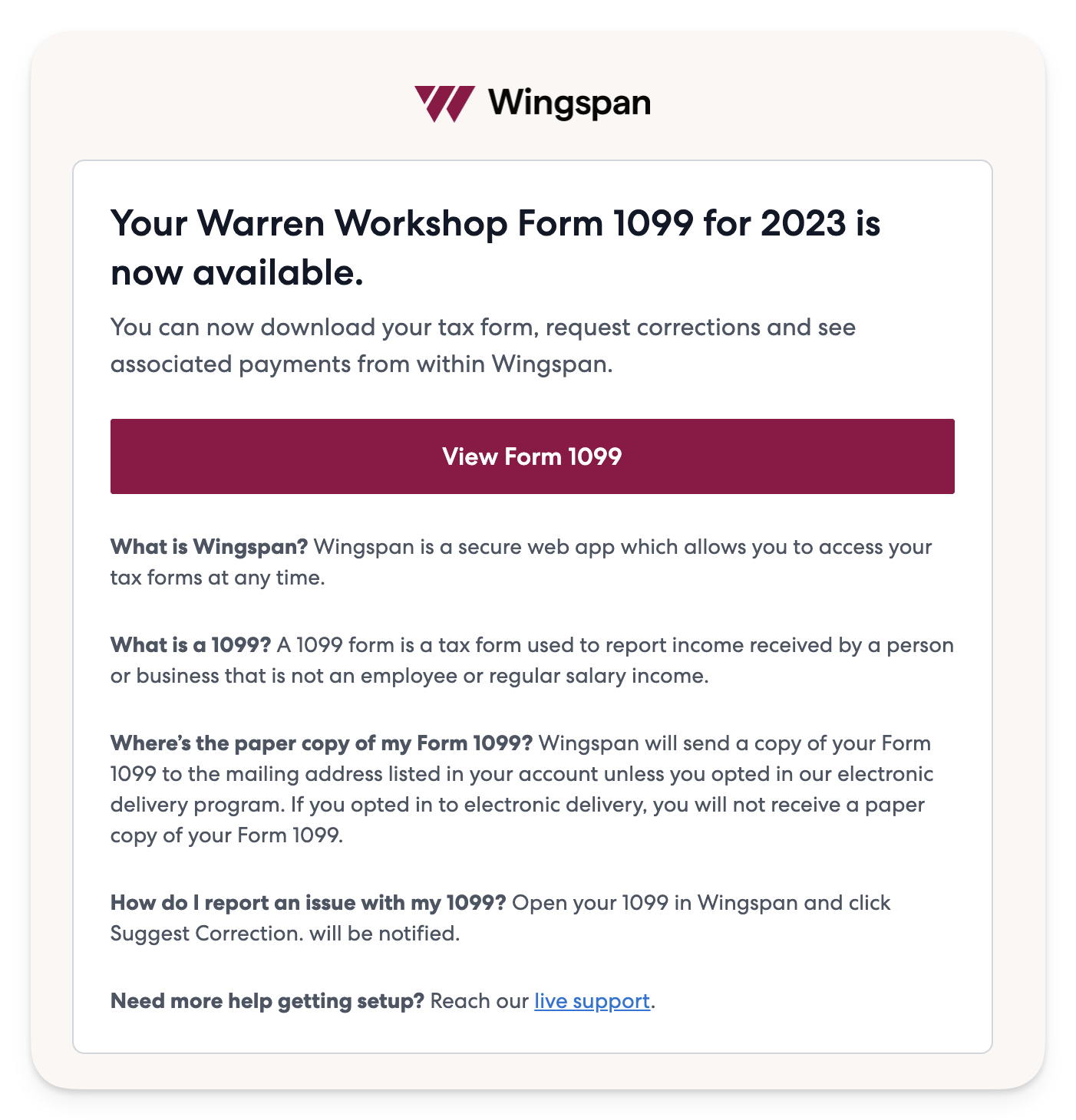

2. Wingspan Automated Email: 1099 is filed

Subject: Your 1099 tax form is ready

Sender: [email protected]

1099 delivery notification

Updated about 1 month ago