Bulk Uploading Off-platform Payments

Include payments made outside of Wingspan so they count toward your 1099-NEC or 1099-MISC (Box 6) totals.

If you've switched to Wingspan in the middle of the tax year or have made payments to contractors outside of Wingspan, import any missing amounts so they are included in your 1099 totals (whether you are filing 1099-NEC or 1099-MISC Box 6).

When to Use Bulk Uploading Payments

Consider bulk uploading if:

- You migrated to Wingspan in the middle of the year and need to consolidate records.

- You've made payments to contractors through platforms other than Wingspan.

- You are using Wingspan primarily for 1099 form filing.

Bulk imports can be executed multiple times until the January 25th filing deadline. Note that imported payments will be visible to your 1099 contractors.

Pre-requisitesBefore importing off-platform payments, ensure the following:

- Off-platform Contractors: All contractors who are expected to receive a 1099 must be uploaded to Wingspan.

- Administrator Privileges: Remember, only administrators are authorized to bulk import off platform payments

Step-by-Step Guide to Bulk Uploading Off-platform Payments

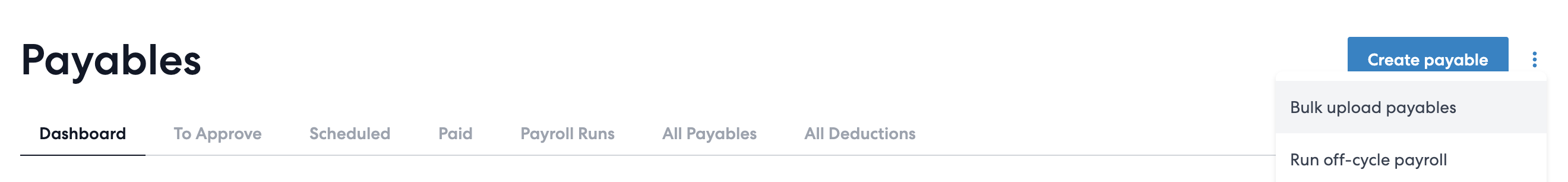

1. Access the Bulk Upload Page

From the Payables list, navigate to Actions (3-dots) > Bulk upload payables (There are also shortcut links on the 1099 Filing Dashboard and on the two bulk upload pages)

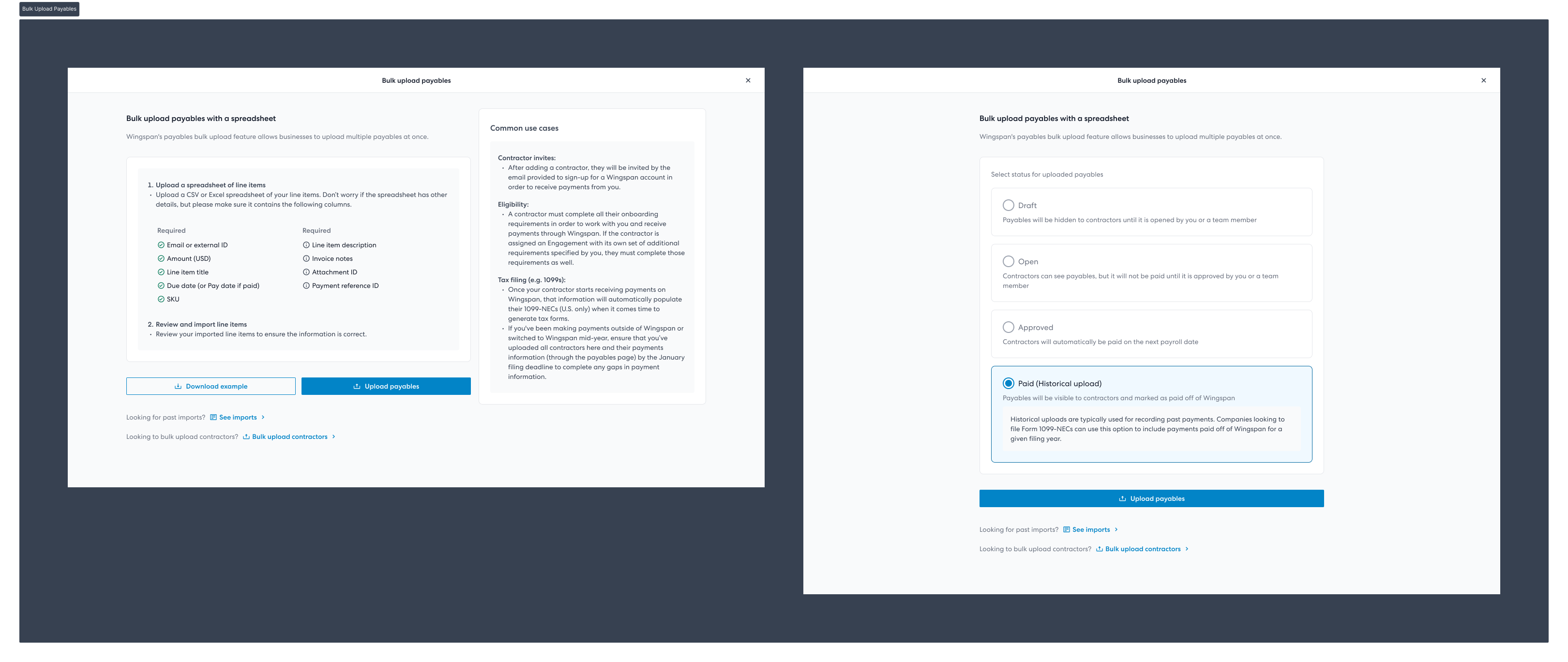

Follow the instructions to prepare and upload your spreadsheets.

To upload payments made off-platform, you will need to provide a spreadsheet (CSV or Excel) that includes the following columns. You can download a template containing all of your contractors by clicking Download template.

| Column Name | Details | Required |

|---|---|---|

| Email or external collaborator ID | Wingspan will use this ID to identify the contractor associated with the payment | Yes |

| Amount (USD) | The payment amount in USD. For example $100 or -$50. This amount can represent the total sum of | Yes |

| Line Item Title | The description of the payment that will appear be visible to your contractors. If you do not have a line item title, you should include other identifying data like an invoice number. | Yes |

| Pay Date | Determines whether the payment should be included in the year’s 1099 calculations (NEC or MISC Box 6). For example, 2025-06-01. | Yes |

| Reimbursable | Whether the payment is reimbursable. True or False | No |

| Line Item Detail | Additional payment description visible to contractors. | No |

| Due Date | Due date of the payment (for reference, not used). For example, 2022-06-01 | No |

Imported payments will appear as payables marked “paid off-platform” and will be visible to your contractors.

Itemized vs. summary paymentsYou can choose to upload off-platform payments in two ways:

- Itemized: multiple rows for each contractor representing itemized line items (recommended)

- Summary: one row for each contractor representing the sum of all payments made outside Wingspan. For the 'Pay Date' please choose any one date in 2025. For example, 2025-01-01.

Wingspan recommends providing itemized payments so contractors can see which payments were included on their 1099.

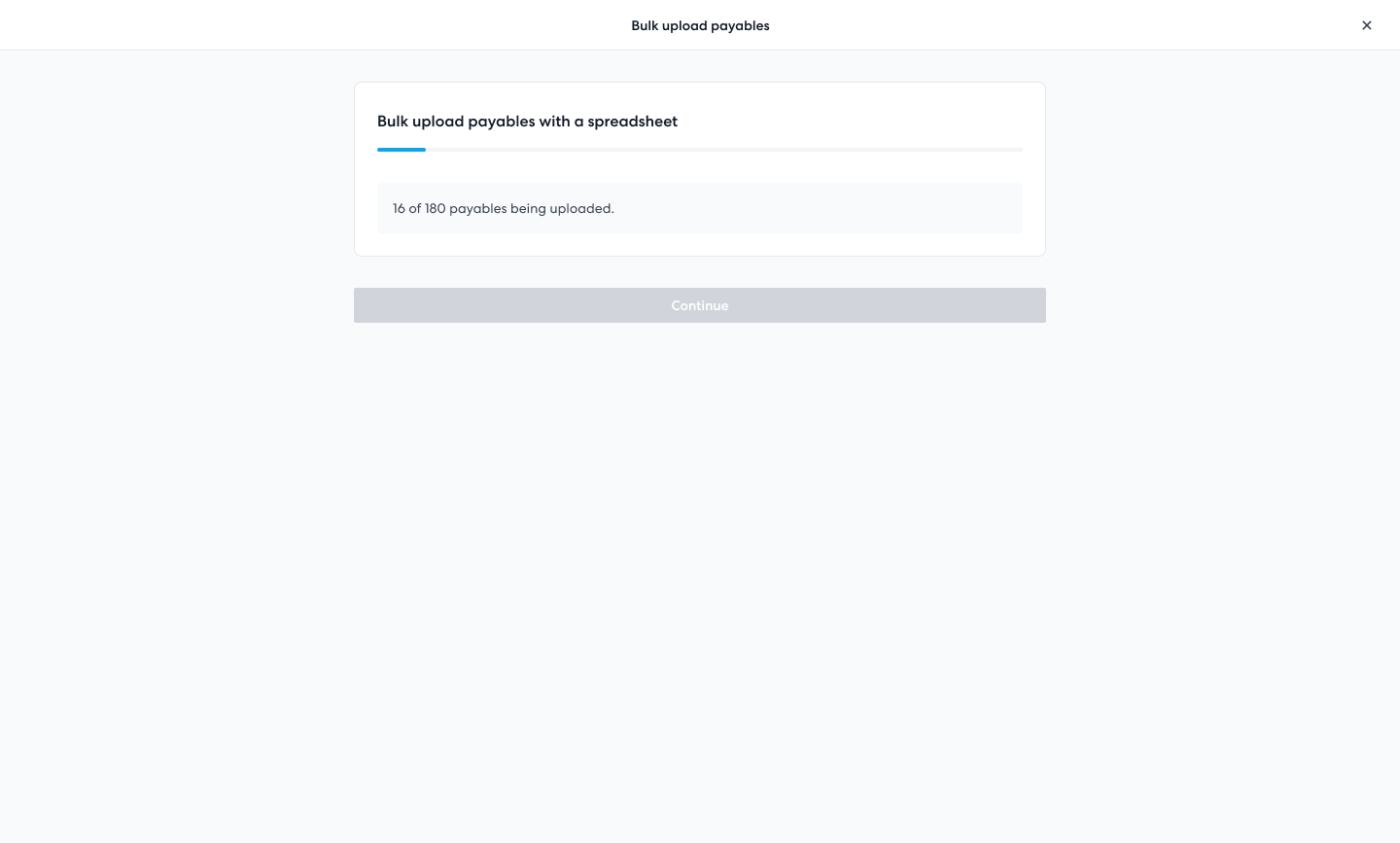

2. Review the payments, and then upload.

3. Your payments are uploaded.

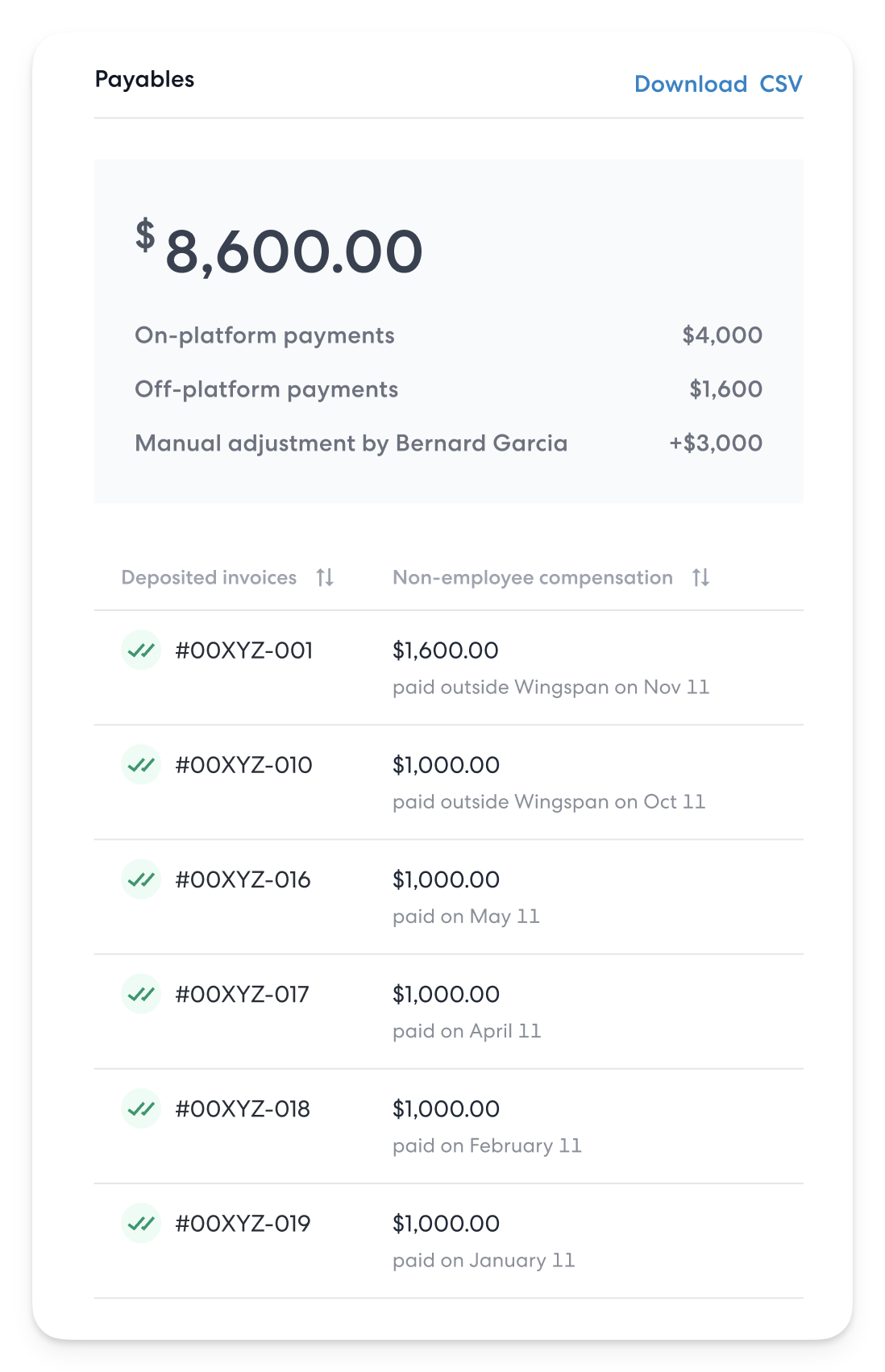

Once the upload is complete, your off-platform payments will be visible in Wingspan to you and the recipient and will appear as "paid outside Wingspan." To include these payments in the 1099 calculations, you will need to generate the 1099 amounts & statuses following the guide.

Updated 19 days ago