Generating 1099s

How to generate, track, and manage 1099 tax forms in Wingspan, including prerequisites, filing statuses, sync options, payment tracking, and form history management.

Starting January 2026, once on-platform payments have settled and off-platform amounts are imported, administrators can calculate 1099 amounts and statuses for both 1099-NEC and 1099-MISC (Box 6) filings.

Pre-requisites

Before generating 1099 amounts and statuses, ensure the following:

- Calculation Settings: Your 1099 filing settings must be configured, including the selected form type (1099-NEC or 1099-MISC Box 6).

- Off-platform Contractors: All contractors who are expected to receive a 1099 must be uploaded to Wingspan. (Learn how)

- Off-platform Payments: Upload all payments made to contractors outside of Wingspan for accurate calculation. (Learn how)

- Review Status Documentation: Familiarize yourself with 1099 statuses to understand Wingspan's status mechanism.

- Contractor Information Documentation: Review how Wingspan determines contractor information via Contractor Information for 1099 Forms.

- Administrator Privileges: Remember, only administrators are authorized to generate 1099 statuses and amounts.

Procedure to Generate

To generate 1099 amounts and statuses:

- Navigate to your tax filing dashboard > Generate tax forms.

- Allow 3-5 minutes for Wingspan to calculate and determine eligibility for each contractor.

- Upon completion, your dashboard will display a list of contractors, including their 1099 status and amount. Full details of each contractor's 1099 form will be accessible.

Reminder: Regenerating amounts & statuses will retain manual edits.You can generate 1099 amounts and statuses multiple times, but be aware that this will only updated forms that are synced with contractor profiles and not overwritten with manual updates by you (or your team). Manual updates on the tax form to contractor information, amount, and/ore statuses will not be updated automatically unless reverted to a synced state. Confirm that all tax forms (synced or not) contain the information you intend to file with.

TIN Verification

Before generating 1099s, Wingspan re-verifies contractor Tax Identification Numbers (TINs) with the IRS to ensure accuracy and prevent filing errors. Here's how the process works:

-

What Gets Verified:

- The contractor's TIN (either SSN or EIN)

- Legal name associated with the TIN

- Whether the TIN is currently valid and issued

-

How IRS Performs Matching: The IRS uses specific rules when matching names to TINs:

- For Individual SSNs: Matches the first four characters of the last name

- For Business EINs: Matches the first four characters of the business name

- Comparison is case-insensitive

- Special characters and spaces are ignored

- For ambiguous cases (when unsure if TIN is SSN or EIN), the IRS checks both databases

-

Verification Results: Each TIN verification will return one of these results:

- Matched: The name/TIN combination matches IRS records

- Not Matched: The name/TIN combination does not match IRS records

- Pending: We're waiting to hear back from the IRS records, usually in under 1 business day

-

Impact on 1099 Generation

- Forms with pending or mismatched TINs will be marked as "Action Required"

- Successfully verified TINs allow forms to proceed to "Ready" status

- TIN verification history is maintained in the form's History tab

- Wingspan will automatically attempt re-verification if contractor information changes

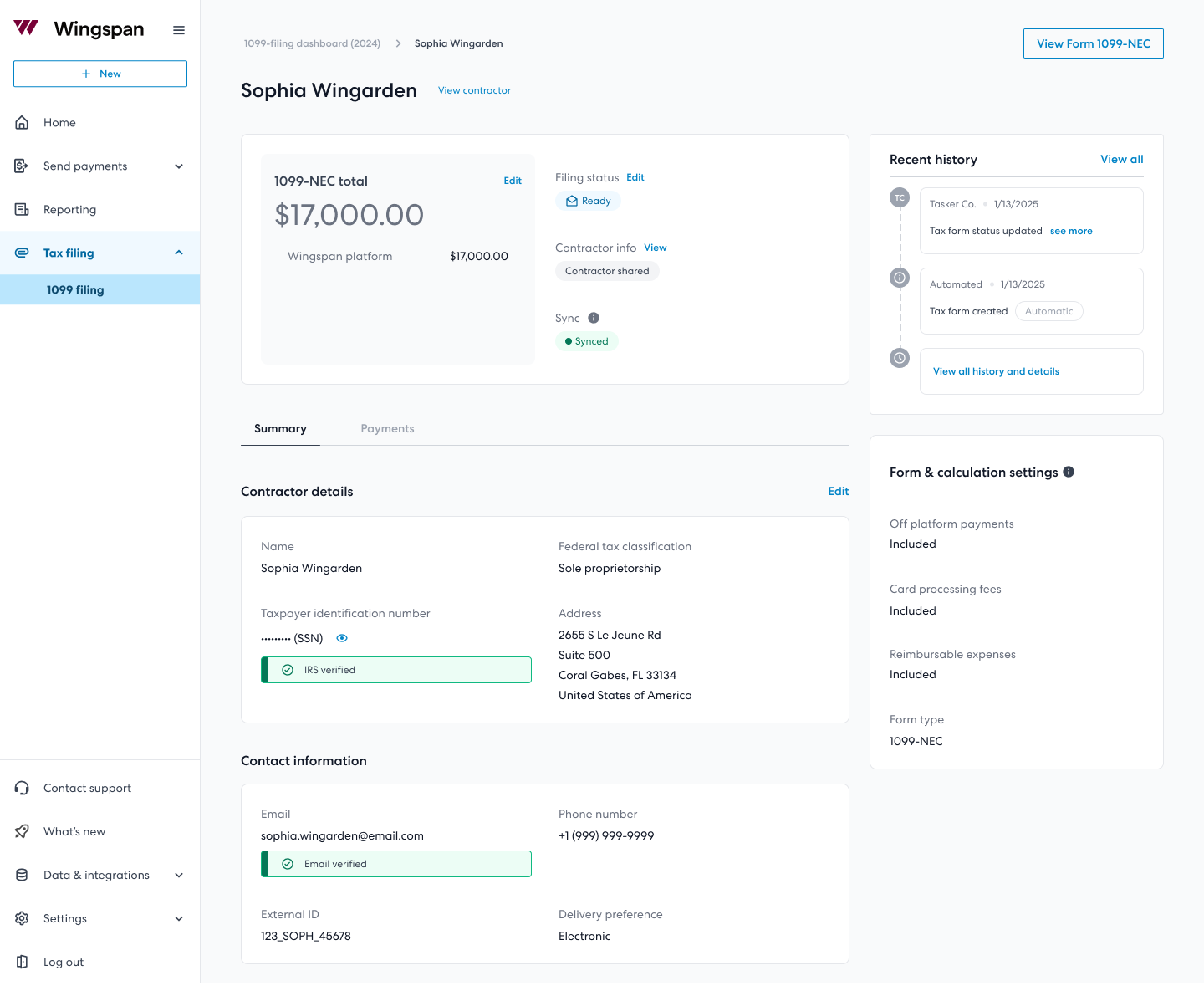

Understanding the 1099 Details Page

1099 detail page (screenshot example)

Filing Statuses

Each filing status on the 1099 form represents a specific stage in the submission process:

- Action required: Indicates missing criteria that the payer must address. A 1099 form shifts to this status if any "Action Required Criteria" is unmet.

- Ready: Signifies that all "Eligibility Criteria" are met, and the form is prepared for submission.

- Submitted: The form has been sent to the IRS but has not yet been accepted.

- Accepted: The IRS has received and accepted the form or its correction.

- Rejected: The IRS has rejected the 1099 submission.

- Excluded: The form is not filed due to specific reasons outlined in the "Eligibility Criteria."

For more details on Filing Status, refer to the detailed documentation.

Sync Status

The sync status in the 1099 detail view indicates the current state of a 1099 form regarding automatic updates and manual edits:

- Synced: This status indicates that your 1099 form remains unmodified by you or your team. This encompasses no alterations in amounts, contractor details, or manual updates to its status. In this 'Synced' state, the 1099 form dynamically updates itself based on any changes in the underlying data (synced with the contractor profile) before it's sent to the IRS. This update process is governed by the Contractor Information Determination Logic. As an example, should a contractor revise their tax details before you file, the 1099 will automatically incorporate these changes.

- Sync disabled: This status appears if you or your team has made any manual adjustments to the amount, contractor information, or status of a 1099 form. These changes could include manual edits to the 1099 details or overrides of the automatically generated information. It's important to note that once a 1099 form is marked as 'Sync disabled,' it will no longer automatically update based on changes in underlying data (and will no longer be synced with the contractor profile, even if changes occur there). This is to preserve the integrity of the manual edits made on the tax form itself.

For guidance on how to update tax forms, including reverting payer edits, refer to Updating Tax Forms.

Grouped Forms

Following IRS regulations, Wingspan calculates the filing eligibility of forms with the same Tax Identification Number (TIN) based on their combined total. Even if an individual form is below the IRS threshold, it may still require filing if the aggregate total exceeds the threshold.

Wingspan files each form separately, even if they share a TIN. If an account is grouped, it will be indicated on the tax forms as shown below:

History

Wingspan simplifies tracking changes made to your 1099 forms. This feature provides a comprehensive history of all events related to your 1099s, facilitating better understanding and collaboration.

| Event Category | Specific Event | Description |

|---|---|---|

| Payer Edits | Contractor data edits (name, TIN, amount, address, status) | Changes made by payers to any contractor data. Includes activation/deactivation of data synchronization. |

| Tax form updates | Contractor profile updates (name, TIN, amount, address) | Modifications to the contractor profile that are synced to the tax form, highlighting changes from previous to current states. |

| TIN Verification | Automated actions (e.g., IRS matching) | Records TIN verification requests and outcomes from IRS. (e.g. verifying overwritten TINs) |

| Submission Actions | Actions to IRS (submitted, rejected, accepted) | Tracks form submissions to the IRS, including rejections and acceptances. |

| Contractor Correction Actions | Correction requests by contractors | Details requests for corrections to address, amount, or name/TIN. |

| Payer Correction Request Actions | Responses to correction requests | Includes payer's acceptance or rejection of correction requests with reasons. |

| Electronic Delivery | Electronic delivery events (e.g., email opened, downloaded) | Tracks electronic deliveries, including multiple deliveries for corrections. |

| Mailed Delivery | Mailed delivery events (sent, delivered, returned) | Details on mailed copies, including status and re-mailing events. |

Note: only changes to the tax form itself will appear in the history. Any events related to contractor onboarding and changes to the contractor profile will be part of the contractor profile history rather than on the tax form.

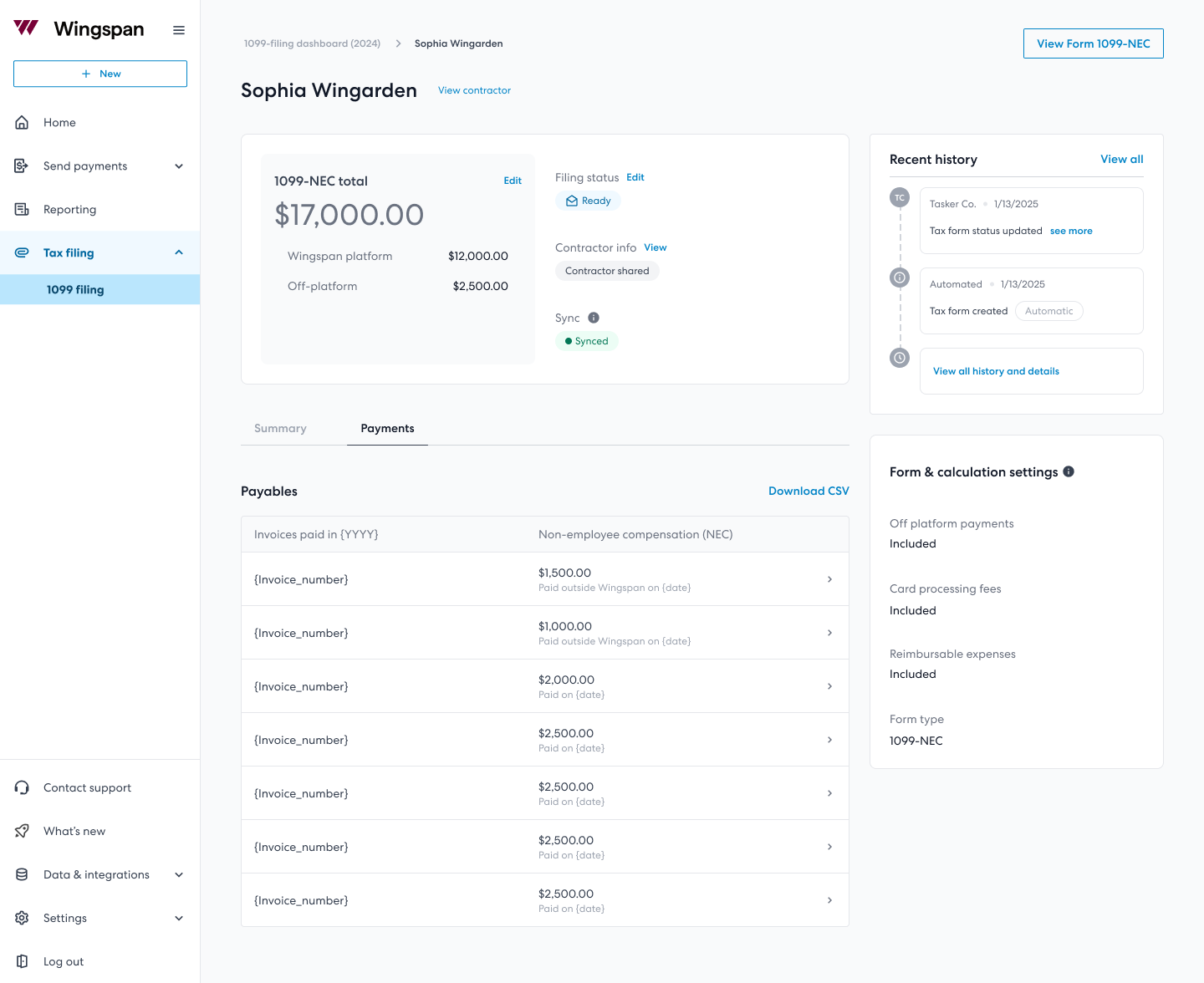

Payments

1099 detail page - payments tab (screenshot example)

The payments tab presents a detailed compilation of all transactions factored into the Non-Employee Compensation Amount. The tab is organized into three line items for ease of review and reconciliation:

-

Off-Platform Payments: This section itemizes payments made outside of the Wingspan system (e.g. added via bulk upload payables), each marked with the specific date of the transaction.

-

Adjustments by Team Members: Here, any manual adjustments to the compensation amounts made by team members are recorded, showcasing the name of the individual who made the adjustment and the exact amount modified.

-

Processed Payments via Wingspan: All payments that have been processed through the Wingspan platform are listed.

For analytical and reporting purposes, a CSV file encompassing all payment details can be downloaded as well.

Payment Calculation Timing

Wingspan calculates 1099 amounts based on the events.paidAt timestamp of each invoice payment, not when the contractor receives the funds. This means:

- For standard payments: The amount is counted in the tax year when the payment was initiated by the payer

- For Instant Payouts: The amount is counted in the tax year when the original payment was scheduled, not when the contractor requested instant access to funds

Example: If a payment was scheduled for 1/2/2026 but the contractor used Instant Payout to access it on 12/31/2025, the amount is still included in the 2025 tax year 1099 calculation.

Appendix: 1099 Generation in Multi-Account Organization Hierarchies

Wingspan’s Organization Accounts feature allows a single “parent” account to maintain “child” (sub) accounts, each of which may inherit properties (e.g. bank accounts) and branding from its parent. When it comes to 1099 generation and filing, there are important nuances to understand if your organization uses multiple Wingspan user accounts.

1. Parent-Oriented (Org-Wide) Dashboard View

- Roll-Up Visibility: A parent account sees a roll-up of all 1099 forms across its sub (child) accounts on the tax filing dashboard. This includes forms generated by each sub account, even if they have different EINs.

- Read-Only vs. Actionable: While you can see sub account 1099s in the parent’s dashboard, each sub account still needs to take its own actions (generate, submit, correct, etc.) for its forms.

Tip: If you see multiple forms for the same contractor in the parent account’s dashboard, it usually means the contractor was paid by multiple sub accounts (or the parent and a sub account). Even if the parent and sub share the same EIN, separate “payer/payee” relationships will still show multiple forms.

2. Each Account Must Generate & File Its Own 1099s

- Account-by-Account Generation: Generation of 1099 forms is always triggered at the account level. A parent account triggers generation for its own paid contractors; each sub account triggers generation for the contractors it paid.

- Separate Filing Actions: Even if a parent and child share the same EIN, submitting (filing) 1099s to the IRS must also be done at the account level. There is no single-button “file everything across the org.”

- Payer Info & EIN: Each account (whether parent or child) has its own “Payer” section in Wingspan settings. If the sub account has a different EIN than the parent, that EIN must be set on the sub account’s Payer Info page before generating forms.

3. Multiple 1099s for the Same Contractor If Paid by Multiple Accounts

- Same EIN Across Accounts: When parent and child accounts share an EIN, a single contractor paid by both accounts will have two (or more) 1099 forms—one created by each account.

- Grouped Forms & $600 Threshold: If multiple forms share the same payer EIN and the same contractor TIN (e.g., SSN/EIN), Wingspan groups them for threshold calculation (see Grouped Forms above). Each form is still filed separately, but the total amount across all these forms is aggregated to see if it meets or exceeds the $600 filing threshold.

- Acceptable Practice: It is perfectly acceptable (and common) to have more than one 1099 for the same payee under the same EIN if the contractor was paid by separate accounts/divisions/entities. Each 1099 will reflect the amounts specific to that account.

4. Practical Example (Fictitious Company Names)

Consider an organization, Solis Media, with:

- Parent Account: Solis Media (EIN #1)

- Sub Account: Solis Media 360 (EIN #1)

- Sub Account: Solis Health (EIN #2)

-

A contractor is paid $300 by the Parent (Solis Media, EIN #1) and $400 by Solis Media 360 (also EIN #1). When generating 1099s:

- The parent account must generate and submit the $300 1099 form.

- Solis Media 360 must generate and submit the $400 1099 form.

- The contractor will receive two separate forms, each listing the paying entity. Because the same EIN is used, Wingspan groups them for threshold calculations (total = $700, therefore meets the $600 threshold).

-

Another contractor is paid $100 by Solis Health (EIN #2). Because EIN #2 is different from EIN #1:

- Only Solis Health can generate and file that 1099.

- This 1099 is not grouped with any other forms because the EIN is different.

Updated 4 months ago